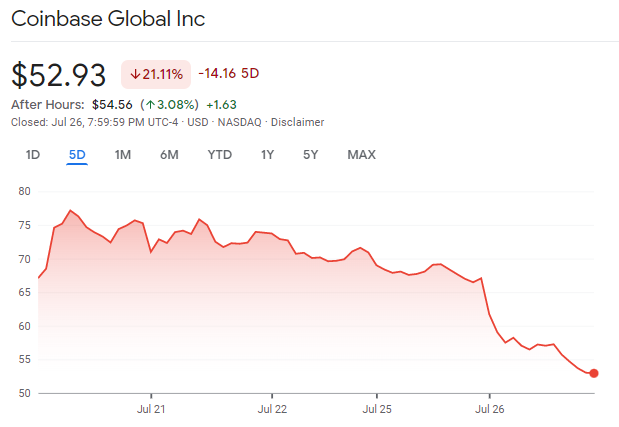

Coinbase Stock Tumbles 20% Amid Regulatory Probe into ‘Unregistered Securities’

Shortly after announcing the first crypto insider trading case, where it identified nine tokens as securities, the US Securities and Exchange Commission (SEC) has now launched an investigation into Coinbase, the publicly listed exchange that listed them:

According to a report by Bloomberg, the SEC is looking into whether Coinbase improperly let Americans trade digital assets that should have been registered as securities. On release of the news, Coinbase stock dropped by 20 percent but recovered shortly thereafter.

What Are Unregistered Securities Anyway?

The term “securities” refers to tradeable financial assets, and under US securities law a company may not offer or sell securities to the public unless the offering has been registered with the SEC. Registered offerings are subject to a plethora of laws and regulations that purport to protect investors.

Full disclosure is one of the core elements required within a public listing, designed to help investors make informed choices, and this is typical not just in the US but across virtually all capital markets.

Some of the required information to be disclosed includes the history of the company and its founders, shareholding structure, financial statements, executive compensation, risk factors (both current and future), management’s explanation of operations, and any other material facts relevant to the offering.

If 90 percent of cryptocurrencies are securities, as has been alleged by SEC chairman Gary Gensler, the question then becomes whether relevant disclosures have been made and if not, who should be prosecuted – the project founders or the listing exchange?

Coinbase Denies It Lists Securities

For its part, Coinbase has previously stated that it does not list securities, arguing that:

Coinbase has a rigorous process to analyse and review each digital asset before making it available on our exchange – a process that the SEC itself has reviewed. This process includes an analysis of whether the asset could be considered to be a security, and also considers regulatory compliance and information security aspects of the asset.

Coinbase statement

It also argues that “the majority of assets that we review are not ultimately listed on Coinbase”. The company’s statement went on to criticise the SEC’s approach of “regulation by enforcement”, and stressed the need for a “concrete digital asset securities regulatory framework”.

Clearly, regulators are cranking up the regulatory pressure and, given that some 20,000 tokens exist across the world, the most viable mechanism for regulation appears to be with exchanges. Centralised exchanges should no doubt be expecting increased scrutiny over the coming months.