Closing Bell: ASX 200 finishes week with a red day, but at least a sand stock (PEC) is well up

“I don’t like sand. It’s coarse, and rough, and irritating. And it gets everywhere.” (Getty Images)

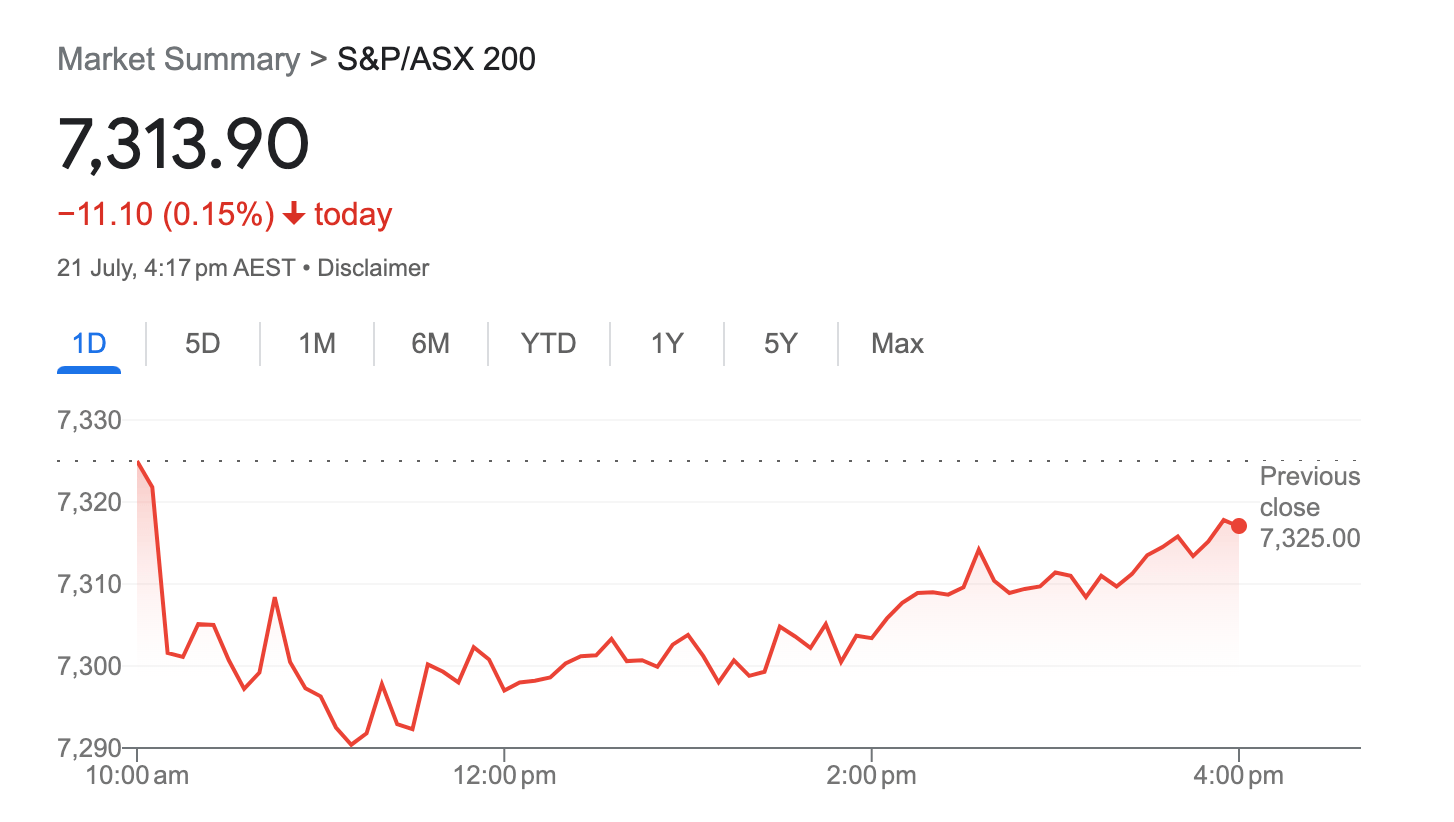

- The ASX 200 started poorly, got worse, and only picked up marginally in the arvo (-0.15%)

- Sectors wise, IT had a shocker after it saw what happened to Tesla and Netflix share prices in the US

- Notable performers today, though: sand stock PEC and medicinal kava outfit The Calmer Co (CCO)

Previously, on the ASX… things (following Tesla and Netflix sell-offs in the US) got off to a shaky start early doors, , getting worse around the time Gregor finished his bowl of cereal.

And then it all tried to make up for things with some chocolates and flowers in the afternoon. Those were accepted, but it was too little, too late. And we’re still not talking to it.

MAKING HEADLINES

We’ll get into some specifics further below, but firstly, a headline act or two from the larger end of ASX town…

• Coking coal producer ($2.76bn market cap) is celebrating 2.8% gainage today. And that’s to do with the company’s quarterly report, which it seems quite proud of.

Essentially, the firm’s saleable production level is up 22% (to 4.5m tonnes) compared with the previous quarterly results it released in March. Its group run of mine (ROM) coal production, meanwhile increased 15% to 7.2m tonnes.

• Gold… hmm, yeah not so great on that front today unfortunately. Certainly not for gold-mining big gun ($23.51bn mc) Newcrest, which fell nearly 5% today after its $29bn buyer, Canada’s Newmont, reported weak quarterly results (per The Aus this afternoon as well as Eddy with his ).

Hang on, not so fast, though. Are there reasons to be cheerful about the world’s “prettiest commodity”? Tim Boreham fields that question for you .

ASX MORE GENERALLY

Very much unlike our awesome women’s football team the Matildas, the ASX 200 has underperformed as a team today, ending in deficit to the melancholy tune of -0.15%.

If only there was another major Australian sporting outfit we could tenuously compare today’s efforts on the bourse with. Which reminds us, how’s the weather in Manchester looking right about now?

Here’s that Australian batting worm from the first innings again, then… Hopefully we’ll be talking about a much better one come Monday.

Stepping in closer to the stump mic, we can hear all sorts of filth coming from, possibly, first slip, sending pretty unoriginal sledging the way of Information Technology in particular.

Financials, Telcos and a few others also copped a few muffled comments behind hands, too, but not as bad. It was all a bit “against the spirit of share markets”, though.

At least Energy, Health Care and Staples were in decent nick.

Source: marketindex.com.au

Source: marketindex.com.au

Were there any standout performers? Yeah, course, it’s rarely ALL bad on the bourse. Before we head to the more exciting part of town for ROIs, here are a couple of other larger market cappers in the green and catching our attention…

• : +18.9% > On no particularly fresh price-moving news we’re spotting.

• : +8.3% > Also on no fresh news.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

Standouts:

• : +40% > The eye-catching sand stock busted a big move today on the back of a Brazilian lithium-focused “binding option deal” regarding exploration ground in Minas Gerais. And that’s 20km from the Grota do Cirilo spodumene mine owned by C$5bn capped Sigma Lithium Corp (TSXV: SGML).

We know this, because we cut and pasted most of those two sentences from Reubs’ good work on the subject earlier in the day. Read all about it .

And, while we’re at it, continuing the grand tradition of this column riding off the back of colleagues’ research, here’s another one we gleaned from Eddy.

• : +33%. “The company formerly called Fiji Kava announced that a new product, Noble Focus, has been launched online today,” wrote Eddy in this morn’s .

“Noble Focus is a synergistic combination providing calm, focus and memory enhancement utilising the proprietary Noble Kava water extract. Noble Focus is targeting the US$4.6bn Nootropics market which has grown at 17% to US$4.6bn in 2023, and includes executives looking for an edge.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

LAST ORDERS

The price of petrol

Stop whingeing, Aussie petrol heads – which is pretty much most of us.

And we say that, because, despite the price of crude oil increasing (again) overnight with a 0.6% hike, it turns out we’re actually in a pretty decent location, globally for petrol prices. Which is strange, but we’ll roll with it.

It’s according to new research conducted by Picodi.com, who could actually be bothered to check the petrol-price changes around the entire globe, calculating how many litres of petrol one can buy with an average wage in over 100 countries worldwide.

We sniffed around the 5th annual Picodi report on this exact topic and here’s what we learnt:

Based on how many litres of petrol an individual can buy with an average salary in 100 countries worldwide:

• Aussies can buy the most petrol in the APAC region, which is 3,669 litres;

• This is 752 litres of petrol more than last year;

• In Australia, petrol costs, on average AUD $1.67/litre, 14 cents less than the continental average.

• Over the ditch in New Zealand, though, what with it being so far away from everything and all, petrol is more like $2.32/litre.

• Malaysia and India are also decent places to pop into a local servo for some gas, a packet of Burger Rings and an iced coffee*, experiencing no petrol price increases;

• Pakistan, on the other hand, saw fuel prices increase noticeably (22%);

• And petrol in Hong Kong is the most expensive both in the APAC region and worldwide, at US$2.99/litre, which is about AUD $4.41/litre.

• Gulf countries, including Kuwait (7,222 litres), Qatar (6,839 litres), and the UAE (4,611 litres) have the highest purchasing power in the global ranking.

(*May not sell Burger Rings.)

You can sift through the full report here.

Bitcoin to the MOON (or at least $42k)

Hang on, crypto? What? How did that sneak in here? Wait, wait, hear us out, because Finder’s predictions are always a bit of a gas.

From reading its latest Bitcoin Price Predictions Report, complied from the crystal ballings of 29 industry specialists and learned people with much better university degrees than mine, we can glean that:

• the panelists, on average, expect BTC to peak at US$42k in 2023

• BTC will end the year priced at US$38k.

• some 43% of panelists believe BTC is underpriced, while 36% think it’s priced fairly and 21% overpriced.

On closer inspection, it turns out that these are roughly the same predictions the panel gave in April. The prediction for the end of the year has risen by $3k, though.

One of the panelists, futurist Joe Raczynski just returned to this reality in his time machine, and sayd BTC will end 2023 slightly higher than the panel average at US$40k “thanks to growing institutional interest”.

“We are finally through the darkness of crypto winter,” he said, dramatically removing his holo-glasses. “With a myriad of top financial institutions submitting an application for a Bitcoin spot ETF, the pressure is on the SEC to approve, and if so, tens of billions of dollars will chase Bitcoin this year,” he added.

“Roads? Where we’re going, we don’t need roads,” an old man with crazy white hair accompanying him unneccesarily chimed in.

Speaking of the future, though, the panel’s predictions didn’t end there. The panel also reckons one Bitcoin will be worth about US$100k by the end of 2025 and more than US$280k by the end of 2030.

Furthermore, the majority of panelists (59%) think it’s time to buy Bitcoin, while 33% say hold and just 7% sell.

They didn’t, however, mention whether the USD will actually be a thing any more in 2030, though. Or anything about flying cars, Jetsons-style roast-chicken dinner pills and so on and so forth.

TRADING HALTS

– Capital raising. Emma has some good Dubber details .

Here’s the topline grab on it: “AI communication service provider Dubber saw adjusted recurring revenue of $8.8m in Q4 FY23, up 18% on Q3 FY23 and 34% on the previous corresponding period (pcp), with FY23 revenues of $30m up 23% on FY22.”

– Capital raising.

– It’s waiting on an announcement regarding material exploration results at its Aileron Project in the West Arunta.

– Pending an announcementregarding a placement to a strategic investor.