Chainalysis Opens Canberra Office after Partnership with CBA Bank

New York-based Chainalysis, best-known as the on-chain data analysis platform, has recently announced its partnership with the Commonwealth Bank of Australia (CBA), opening its new office in Canberra due to increased mainstream adoption and demand for their product.

The new Chainalysis office aims to strengthen its presence in the Pacific region, supporting the local cryptocurrency market, public sector agencies, and financial institutions. The leading blockchain analytics firm also plans to offer crypto trading services to 6.5 million app users.

The crypto exchange and custody service, designed by CBA, will offer a new feature to its clients using its Commbank app. The bank plans to provide customers with access to up to 10 crypto assets including Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

Last year, Chainalysis struck up partnerships with leading Australia-based payments provider Assembly Payments and cryptocurrency exchanges CoinSpot and CoinJar to improve compliance standards. During that time the company has more than doubled the number of cryptocurrency customers.

With the official opening of the Canberra presence, I’m excited to see how we can work even closer together with the Chainalysis team to allow Australia to fully embrace cryptocurrency and reap the benefits.

Caroline Bowler, CEO, BTC Markets

Partnerships to Strengthen Compliance

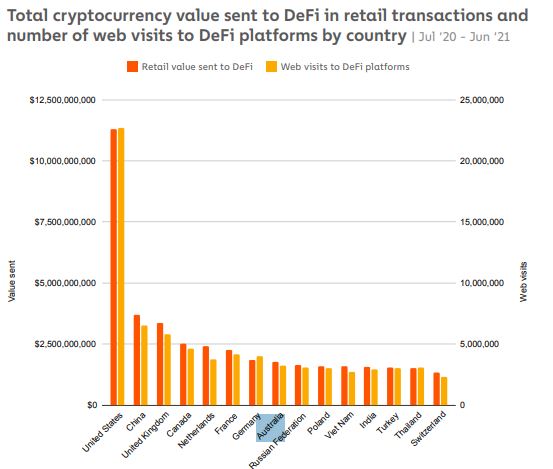

With Australia ranking 38th in terms of global cryptocurrency adoption, Chainalysis’s new Canberra office will enable continued, compliant validation of cryptocurrency. Australia also currently ranks 12th in DeFi adoption.

From working with Chainalysis, we have the confidence that our business is compliant with local regulations, enabling us to continue to build and maintain client trust,

Caroline Bowler, CEO, BTC Markets

Ulisse Dell’Orto, the company’s managing director for the Asia-Pacific region, added: “Chainalysis’s data platform will strengthen the trust necessary to further legitimise cryptocurrency as an everyday asset for retail and institutional investors alike.”

The transparency provided by Chainalysis means that as an industry we can begin to truly build a trusted and compliant foundation for cryptocurrency, giving the reassurance and confidence to our customers that they need.

Alex McCorkindale, head of compliance, Easy Crypto

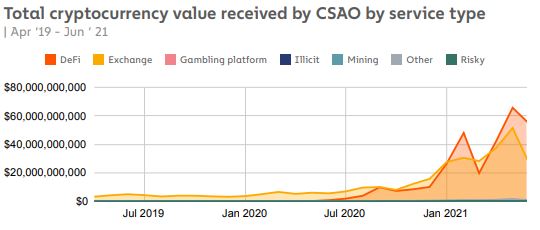

Crypto Usage Increases in CSAO Region

According to its 2021 Geography of Cryptocurrency Report, Chainalysis found Central & Southern Asia and Oceania (CSAO) to be the fourth-largest cryptocurrency market, accounting for 14 percent of all cryptocurrency value transacted between July 2020 and June 2021. CSAO’s transaction activity grew by 706 percent compared to last year in terms of raw value.

“The Pacific region is quickly becoming a centre for cryptocurrency innovation,” said Todd Lenfield, country manager for ANZ at Chainalysis. “Our increased investment in the region will ensure businesses and governments can explore digital asset ecosystems in a safe, compliant manner.”

With the growth of crypto increasing all over the world, each country finds its uses for digital assets. In Africa, crypto adoption has surged 1200 percent due to its P2P use cases.

In June, Chainalysis announced its Series E funding round, raising US$100 million and bringing its valuation to over US$4 billion. Chainalysis will use the funding to build out its vision as the blockchain data platform.