BTC Milestone: 90% of Supply Issued and Mining Difficulty Hits All-Time High

This past weekend marked a momentous occasion in Bitcoin’s history as supply issuance crossed the 90 percent mark. As the 19 millionth block was mined, Bitcoin Takeover founder Vlad Costea commented: “There are only 2 million BTC left to mine in the next 118 years!”

‘Scarcity Intensifying’

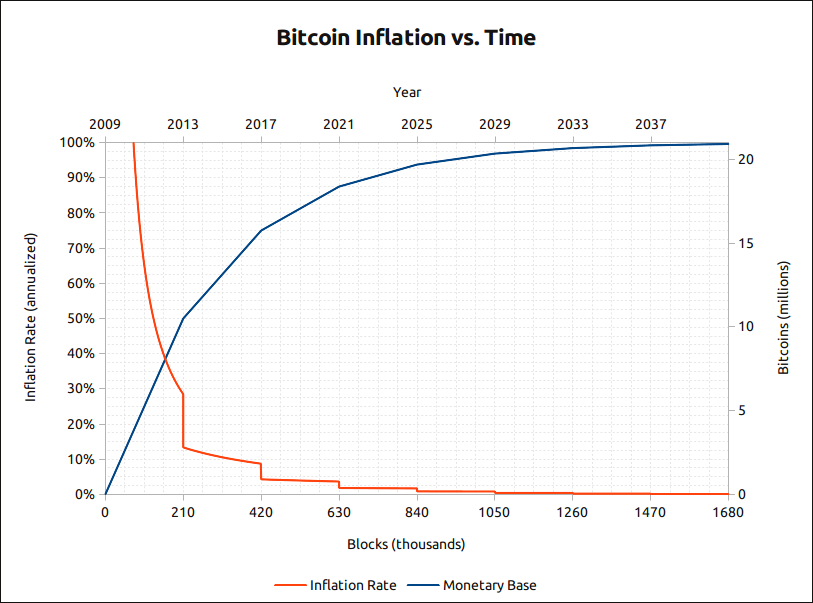

In and among celebrations on Twitter, many users took the opportunity to comment on Bitcoin’s remarkably well-designed inflation model. As illustrated above, the bulk of Bitcoin’s 21 million hard cap issuance is front-loaded in the early years.

With the block reward halving every four years, and the next being scheduled in 2024, Bitcoin’s scarcity is becoming increasingly self-evident:

Mining Difficulty Soars

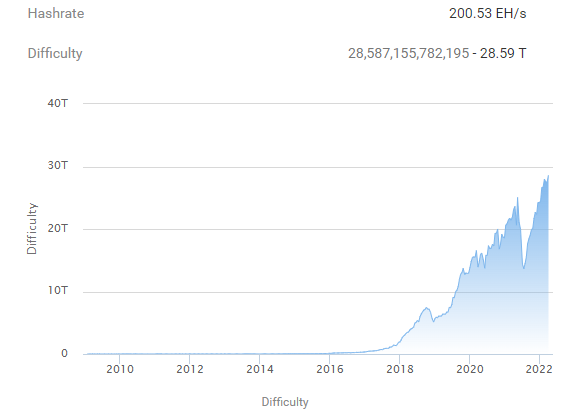

To recap, mining difficulty is a relative measure of how difficult it is to find a new block. This is adjusted on a periodic basis correlated to the hash power being deployed by the network. The greater Bitcoin’s hash power, the more difficult it becomes to find blocks.

Amid the excitement of Bitcoin reaching the historic 90 percent issuance rate, the network also recorded its highest mining difficulty to date, rising 4.31 percent to 28.59 trillion. Notably, mining difficulty is up 100.6 percent from its 2021 low of 13.68 trillion.

A recent illustration was in 2021, when China banned Bitcoin mining (again), resulting in the network difficulty reducing by 16 percent as significant hash power was taken offline.

The long and short of it is that an all-time high for mining difficulty makes it more difficult than ever for Bitcoin miners to “find” blocks, making the network even more robust and secure than before. Remarkably, this is the second time in three weeks it has reached such a milestone.