Bitwise Predicts Record $36B Surge in U.S. Bitcoin ETF Inflows by Year-End 2025

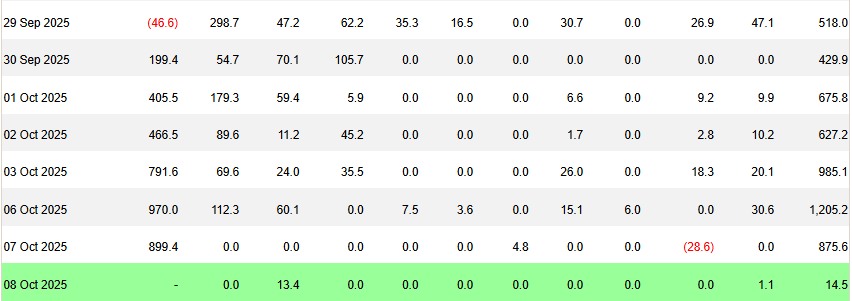

- US spot Bitcoin ETFs are experiencing unprecedented inflows, with Monday alone seeing US$1.2 billion added after BlackRock’s figures were included.

- Tuesday brought an additional US$875.6 million in net inflows, driven primarily by BlackRock’s IBIT, despite outflows from Grayscale’s GBTC.

- Bitcoin currently trades at US$121,841, just 3.6% below its all-time high of US$126,198 recorded on 7 October 2025.

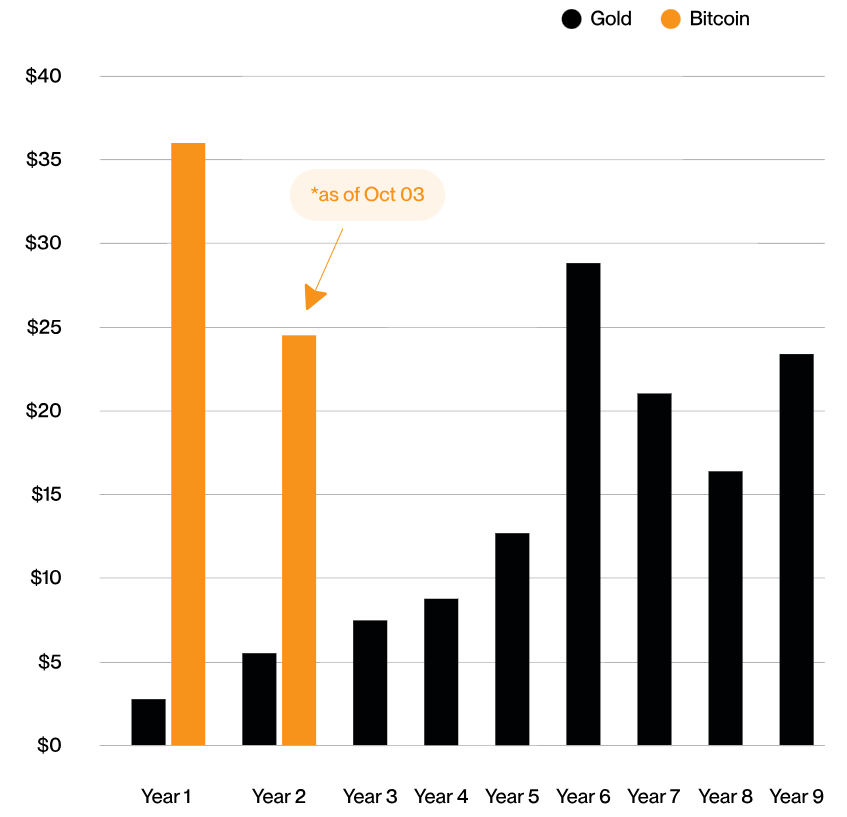

- Bitwise’s CIO forecasts US$36 billion in Q4 2025 ETF inflows, with Bitcoin ETFs significantly outperforming gold ETFs in their first two years of trading.

After a record week of net inflows, the US spot Bitcoin exchange-traded funds (ETFs) are on track for an even better week. While last week saw US$3.23 billion (AU$4.89 billion) added to the ETFs, we reported that Monday brought another US$220.1 million (AU$332.2 million).

However, those numbers were incomplete, as BlackRock’s US$970 million (AU$1.47 billion) inflows hadn’t yet been reported — bringing Monday’s total net inflows to US$1.2 billion (AU$1.8 billion).

Tuesday was a similarly strong day for IBIT, with US$899.4 million (AU$1.36 billion) added, while most other ETFs remained flat, bringing the day’s tally to US$875.6 million (AU$1.32 billion) in net inflows — as Grayscale’s GBTC saw US$28.6 million (AU$43.3 million) in outflows.

Wednesday’s numbers are not fully available at the time of writing, but the trend suggests buying is still strong, with Bitcoin hovering near record highs. Currently, BTC trades at US$121,841 (AU$184,582), just 3.6% below its all-time high of US$126,198 (AU$191,206) from 7 October 2025.

Related: Sen. Lummis Says U.S. Bitcoin Reserve Could Launch ‘Anytime’ Amid Policy Push

Expect Strong ETF Flows for Rest of 2025, Says Analyst

Bitwise CIO Matt Hougan forecasts that US ETFs will smash records in Q4 2025, with inflows expected to exceed US$36 billion (AU$54.4 billion) amid a continued Bitcoin rally and surging institutional demand.

From where I sit, the stars are aligned for a very strong Q4 for flows — more than enough to push us to a new record (and a new all-time high in bitcoin’s price).

Bitwise CIO Matt Hougan

Bitwise CIO Matt Hougan Backed by approvals from major wealth managers and renewed faith in Bitcoin as a hedge against currency debasement, the asset is set to lead global investment flows into 2026, the analyst believes.

The Bitcoin ETFs have also performed well compared to gold ETFs, as Bitwise’s chart shows. In their first year of trading, BTC ETFs easily outperformed their gold counterparts — and in year two, despite it only being October, they’re already taking the lead again.

Related: S&P Unveils ‘Digital Markets 50’ – A New Index Bridging Wall Street and Web3