Australians Made $2.1 Billion in Gains from Crypto in 2021

Australians realised US$2.1 billion in crypto gains in the 2021 calendar year, putting Australia in 17th place globally for annual realised crypto gains, according to blockchain analytics firm Chainalysis.

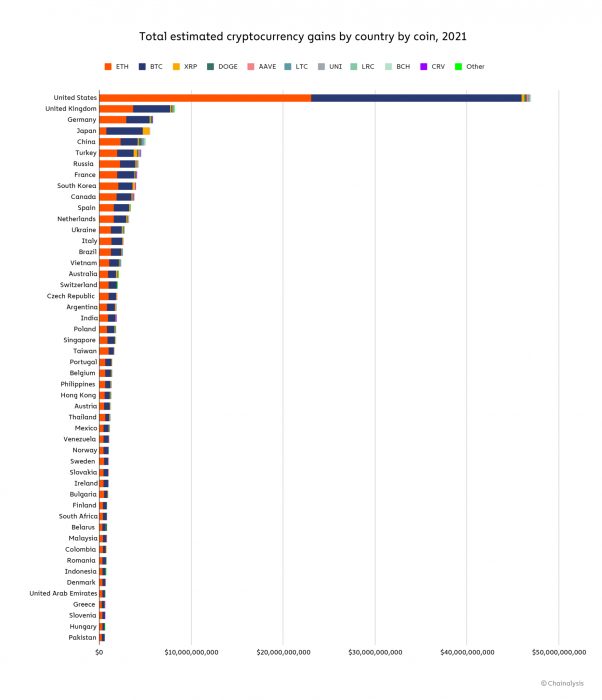

Globally, gains were up more than five-fold compared to the previous year, increasing from US$32.5 billion in 2020 to US$162.7 billion in 2021, with the US seeing the most gains by a wide margin:

Many Countries Record Increases of 400-500%

This is the first year that Chainalysis has reported annual gain data on cryptocurrencies other than Bitcoin (BTC), so it’s hard to draw direct comparisons – but based on the BTC data, it appears gains in Australia are up around 5x, which is in line with similar economies around the world. In 2020, Australia saw around US$0.2 billion in BTC gains, while in 2021 this figure was close to US$1 billion.

Many other countries saw similar increases: the US recorded growth of 476 percent, from US$8.1 billion to US$47.0 billion; UK gains grew 431 percent; and gains in Germany were up 423 percent.

China’s gains increased from US$1.7 billion to US$5.1 billion, a modest gain of 194 percent. This relatively subdued growth is most likely a reflection of the Chinese government’s crackdown on crypto activity over the past year.

Majority of Gains From Ethereum

On a per-crypto basis, the majority of realised gains globally came from Ethereum at US$76.3 billion, with Bitcoin coming in second at US$74.7 billion.

Chainalysis attributes Ethereum’s dominance to the explosion in DeFi in 2021, saying:

We believe this reflects increased demand for Ethereum as the result of DeFi’s rise in 2021, as most DeFi protocols are built on the Ethereum blockchain and use Ethereum as their primary currency.

Chainalysis

Good Signs for Crypto

Chainalysis believes its data shows that crypto is in a vigorous growth phase and suggests it still represents a good economic opportunity moving forward, explaining:

While there are still risks the industry must work to mitigate, the data not only shows that crypto asset prices are growing, but also that cryptocurrency remains a source of economic opportunity for users in emerging markets.

Chainalysis

The crypto environment in Australia in particular looks bright, with increased regulatory clarity on the way and numerous crypto ETFs set to launch in the coming weeks.