Arthur Hayes Says China Capital Flight Could Shake Up Macro Climate – Could It Affect Bitcoin?

Possible capital flight from China is an important trend to watch, according to controversial BitMEX founder and crypto veteran Arthur Hayes.

Google Finance data indicates the Chinese yuan (CNY) has fallen by more than 5% against the US dollar since the beginning of 2023.

Hayes tells his 394,100 followers on the social media platform X that he spoke with Andrew Collier, a China analyst and the managing director of Orient Capital Research, about potential Chinese capital flight.

Collier reportedly said the best way to track the potential trend is to measure the difference between China’s net export earnings (the amount of export earnings minus import costs) and the country’s foreign exchange reserves (the foreign currency reserve assets held by China’s central bank).

China’s foreign exchange reserves have increased by around $32 billion since the start of 2023, according to Bloomberg data. Data from Trading Economics indicates China’s trading surplus year-to-date sits around $553 billion.

Hayes concludes that this means around $520 billion “has left China to do something.”

Says the crypto veteran,

“Some possibilities:

1. China is buying a lot of gold

2. China is paying down USD offshore debt of its banks and corporates

3. Some wealthy comrades are fleeing the coop

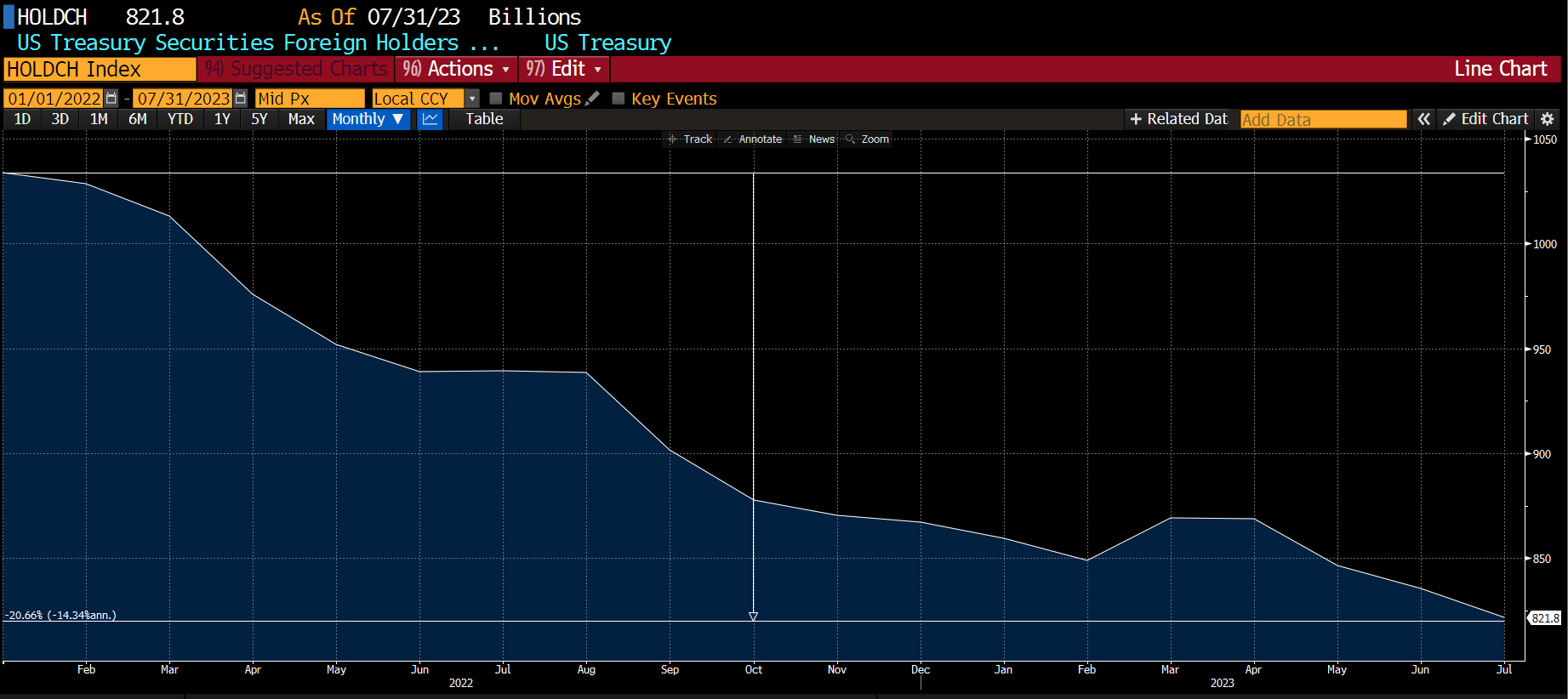

Most importantly what China is not doing is: BUYING MORE US TREASURIES!!!!!

As long as the JPY (Japanese yen) weakens, the CNY must weaken so that Chinese exports remain competitive vs. Japan. Wherever the Chinese capital is going, it will keep going in SIZE. I hope some finds its way to Lord Satoshi and BTC.”