Altcoin Season on the Ropes? Why “Uptober” Isn’t a Guarantee This Year

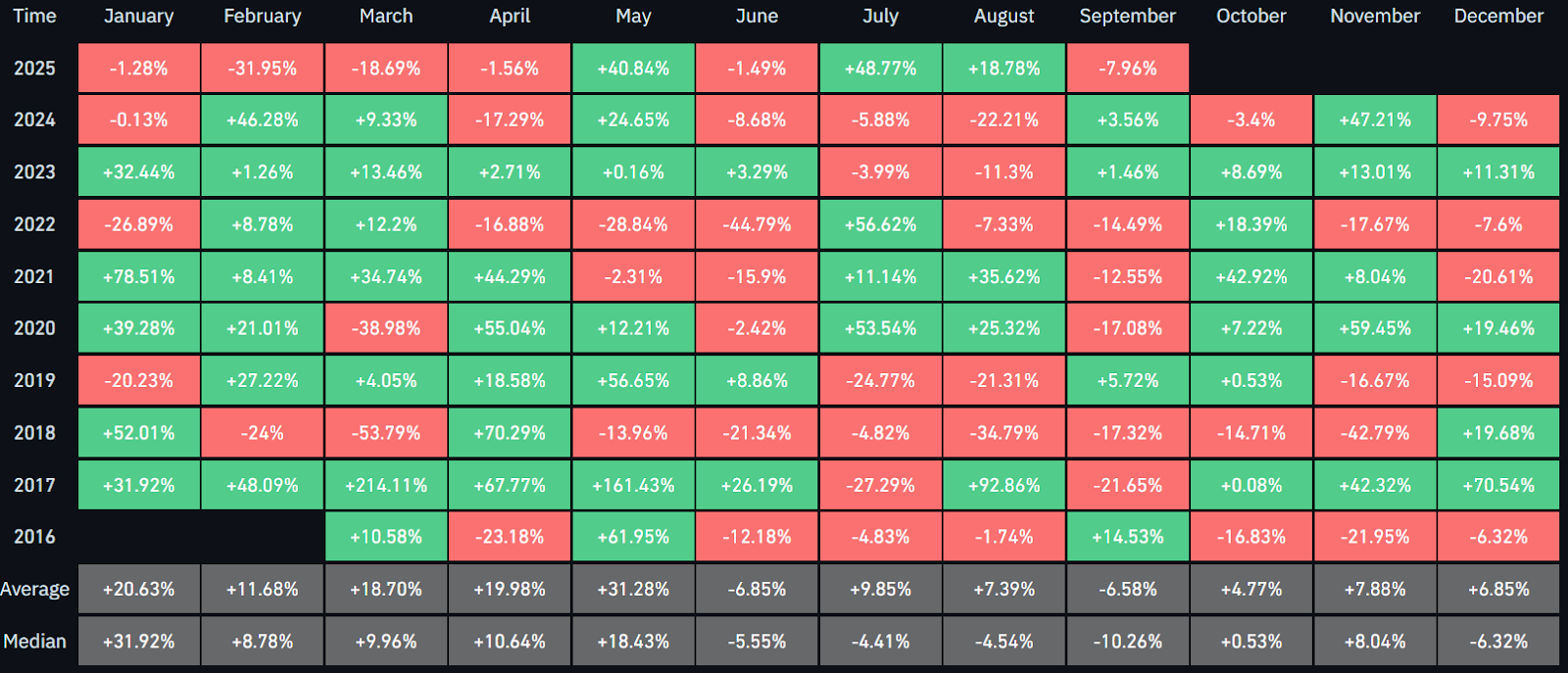

As September goes, this one appears to be ending with an 8% drawback for the altcoin market. That is, if we judge it by Ethereum’s pullback, which represents the altcoin market as the second largest cryptocurrency behind Bitcoin. Historically, quarter three is the period with most months in the red, with September as one of the least performant months.

In contrast, October tends to be the most performant for crypto investors, earning the nickname ‘Uptober’. However, this was not the case last year, when Uptober failed to deliver on its promising moniker, ending up with negative 3.4% gains.

The question is whether crypto investors should expect the same failure this time around. So far, so good – but let’s examine the potential drivers to determine the likely direction.

Is Ethereum Still the Altcoin Market Indicator?

Year-to-date, Ethereum (ETH) gained 20.5% value, just slightly above Bitcoin’s gains of 16.8% for the same period. Among thousands of altcoins, Ethereum holds 12.8% market dominance, down from the peak of ~22% in late 2021, now roughly at the same level as in late 2024.

When Ethereum outpaces Bitcoin, and when Bitcoin’s dominance declines, this typically signals the altcoin season. As previously mentioned, Ethereum’s YTD performance is not that impressive compared to Bitcoin. However, Bitcoin dominance has dropped to 57% from the peak of 65.1% in late June.

Moreover, the altcoin market capitalisation, excluding Bitcoin, is now at $1.84 trillion, higher than the peak of $1.76 trillion in late 2021. Lastly, Glassnode data shows inversion of BTC vs ETH perpetual futures volume, with Ethereum’s surging to 67% – a record high.

What does that mean exactly?

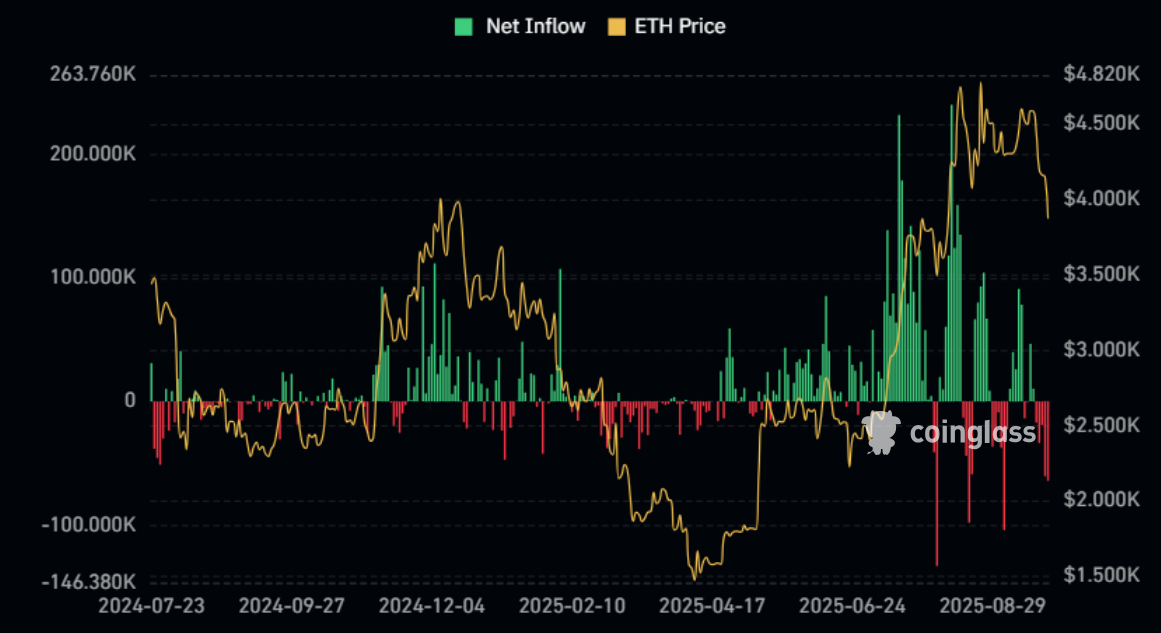

Ethereum has been the beneficiary of institutional flows, derivative dominance and investor confidence, indicated by more inflows than outflows from ETH exchange-traded funds (ETFs) during the year. However, the most recent ETF data for Ethereum indicates institutional pullback.

Together with Bitwise and Grayscale, BlackRock and Fidelity sold off over $140 million worth of ETH outflows last week. While this indicates a continuation of the trend into October, it bears keeping in mind that it was somewhat expected that investors would lock-in profits.

Namely, when Ethereum’s Market Value to Realized Value (MVRV) ratio gets closer to 2.4, this signals a market top. Just prior to the Federal Reserve’s decision to implement a rate cut, Ethereum’s MVRV ratio was closing in on 2.0. After the Fed’s rate cut, Ethereum’s MVRV ratio began retreating, which aligns with the profit-taking behaviour visible in ETF outflows.

This suggests that while ETH had institutional momentum earlier in the year, investors are growing cautious about sustaining that trend into Q4.

What remains the case is that Ethereum holds by far the greatest market share among real-world assets (RWAs) at 52.2%, alongside the highest dApp count, developer activity and on-chain revenue compared to its rivals like Solana (SOL), Avalanche (AVAX) and others.

In the end, Ethereum continues to serve as the altcoin market’s bellwether. The problem is, the altcoin market continues to suffer great dilution of both capital and attention, owing to the non-stop influx of new tokens.

Macro Winds and Market Psychology

It is no surprise that heavily capitalized assets tend to lose retail interest, especially with so many altcoin options on the table. After all, much greater capital needs to be injected for the price to push up even a little bit.

For traders seeking outsized gains, Ethereum may appear “too big to move,” particularly when smaller-cap tokens can deliver double-digit swings within days. This constant rotation of attention has become one of the biggest drags on altcoin season, diluting capital across thousands of projects rather than concentrating momentum.

We have already seen new stars rise over the last three months, greatly outpacing Ethereum:

- MYX Finance (MYX) – a multi-chain decentralized derivatives exchange (DEX) with zero slippage trading – up 10,054%

- MemeCore (M) – the evolution of EVM-compatible memecoins – up 3,338%

- Aster (ASTER) – another multi-chain DEX – up 2,057%

- Plasma (XPL) – for stablecoin-focused global payments – up 670%

- OKB (OKB) – a utility token for OKX ecosystem, launched by the former OKEx crypto exchange – up 282%

And these are just tokens with above 200% gains over the last 90 days. This tells us that crypto interest is still strong but made much more complicated, with capital spreading thinly rather than concentrating in Ethereum or other large-cap names, irrespective of their sound fundamentals.

At the same time, macroeconomic conditions remain a wildcard. The Federal Reserve’s rate cut was expected to provide a liquidity boost, yet ETF outflows and declining MVRV ratios show that institutions are treading carefully.

A slightly stronger U.S. dollar index (DXY) has also been pressuring risk assets across the board, crypto included. Meanwhile, capital isn’t fleeing crypto altogether, but it’s becoming more choosy. Instead of blindly chasing everything that launches, investors are concentrating on niche narratives and meme liquidity rotations where explosive upside is more likely.

The Bottom Line

On one hand, the growth of Layer-2 ecosystems like Arbitrum and Optimism, as well as the steady adoption of stablecoins and DeFi protocols, provide ETH with a foundational demand driver. Much like equities where investors weigh total return and yield, crypto markets demand careful consideration of both fundamentals and momentum.On the other hand, the lack of a clear narrative, such as 2021’s NFT mania or 2020’s DeFi summer, means the capital rotation into altcoins may remain muted.

The most performing altcoins are ones that are heavily focused in the DeFi narratives, multi-chain trading and stablecoins. On the macro front, another wildcard is recession risk. If economic data continues to weaken despite the Fed’s policy shift, the narrative could flip from “liquidity boost” to “growth scare.”

In that scenario, equities and crypto alike might struggle, as investors retreat to cash and bonds rather than chasing risk assets. For altcoins in particular, which depend on speculative flows more than Bitcoin, a recessionary backdrop could suppress any seasonal upside – even if October has historically been favorable.