“2021 should be a Good Year” says Australian Analyst as Ethereum Breaks $1,000 and Bitcoin Turns 12

Despite the majority of news focusing on market leader Bitcoin, Ethereum had a much better year than the king of crypto, providing a 600% return-on-investment (ROI) during 2020.

After a massive week-long rally that saw Ethereum double in price and break through the significant $1,000 price point, Australian market analyst Kyle Rodda told news.com.au that “2021 should be a good year” for the cryptocurrency.

However, the sudden gains faced severe resistance around the US$1,200 mark, getting knocked back down to US$892 before recovering to current levels. ETH is now back up above $1,100, with Bitcoin up 16% after suffering 13% losses and dumping almost US$4,000 in one hour on Monday.

The movements could indicate the start of the ever-elusive alt-season that crypto altcoin investors have been patiently waiting for since the current bull market started last year. As popular Crypto Twitter voice GalaxyBTC pointed out:

“This $BTC correction was all we needed to finally ignite the #altseason.”

As a result of the huge gains, Ethereum gas fees are skyrocketing again, rendering the network inefficient for the massive decentralized finance (DeFi) market that relies largely on Ethereum’s ERC20 protocol to function.

Happy Birthday Bitcoin!

The cryptocurrency market has been on a tear recently, with leading asset Bitcoin (BTC) smashing records and hitting new highs almost daily. The price movements mimic the 2017 rally that saw Bitcoin rise from a new all-time high (ATH) of around $1,000 to almost $20,000 per coin in less than a year. Should the same scenario play out this time around, Bitcoin could reach $400,000 per coin before the end of 2021.

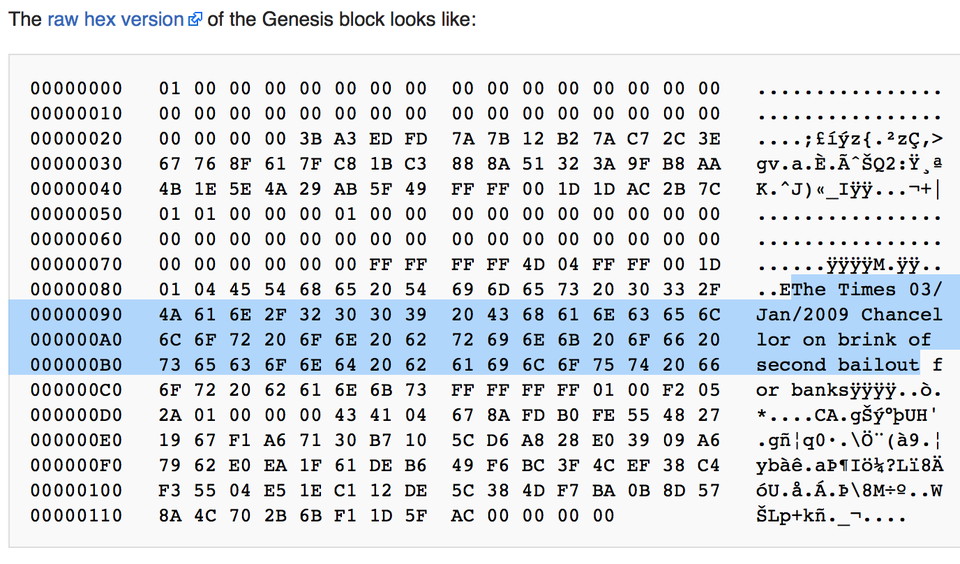

Yesterday, on January 3, 2021, Bitcoin celebrated its 12th birthday with huge gains that took it to a new ATH above AUD$40,000. The mysterious and pseudonymous creator, Satoshi Nakamoto, mined the very first Bitcoin block (the genesis block) on January 3, 2009, forever encoding in history a news headline from the day: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Many believe the meaning of the encoded headline is to reiterate Bitcoin’s intention as an autonomous and incorruptible replacement for badly managed government-issued money.

Institutional investment continues aggressively

Speaking to Forbes yesterday, US-based blockchain developer James Reilly from decentralized hosting platform Ether-1 said “BTC is becoming more mainstream.” The level of institutional interest today is much larger than during the 2017 rally, when cryptocurrencies were largely considered a risky, unreliable investment.

With multinational investment firms like Grayscale and tech giants Paypal pouring money and research into the crypto market, this new rally could unfold in a unique fashion. While adoption and investment are typically a positive sign for an asset class, in the case of cryptocurrency, it’s also attracted intense regulatory scrutiny. The two opposing forces of regulation and adoption will need to find a suitable balance if the crypto market hopes to mature in a sustainable way.