New Crypto Traders Panic Over Recent Price Dip

In the past week Bitcoin (BTC) has gone through a few price dips – the kind of situation that could scare new investors causing them to sell-off their assets in fear of losing everyting.

Has anything actually changed though? Has something triggered the drop in price? Is there a reason to panic?

The market has shown various times that when public sentiment about cryptocurrency lowers due to some public figure or negative news there are people who sell their assets. This looks like an emotional reaction with little regard for fundamentals.

In a post by Glassnode they state that there are “strong signals that short-term holders are leading with panic selling”. Bitcoin which is down to $44,757 USD at the time of writing from $55,000 USD one week ago is seemingly being driven by weak hands.

[…] weak hands traders have predictable buying and selling behaviors as they are driven by fear, uncertainty, and doubt (FUD).

Bryce Lippai on Binance Academy [source]

Long Term Holders Buying The Dip

While the long-term price action seems to be driven by the monetary preferences of the world changing from fiat money to crypto, short-term price action is driven by leverage and derivatives markets.

As the price of Bitcoin has dropped to around $44,000 USD, it looks like institutions are buying the dip. The recent three-month consolidation can be thought of as bitcoin simply moving from weak hands to strong ones.

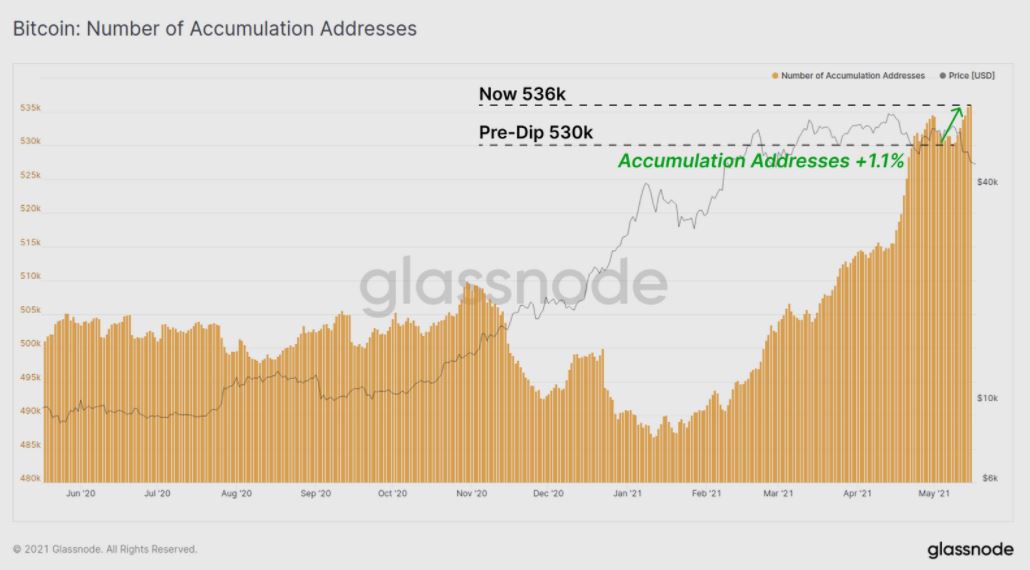

There is also an increase in accumulation addresses, which are thosethat have at least two incoming transactions but have never spent any coins. This suggests that long term investors are buying this dip too.

The Importance of Research

An important phrase in the crypto world is “Do Your Own Research” (DYOR), meant to encourage people to understand what they are buying so that they get to know the project or technology they are investing in. By not just following sentiment, investors can feel more secure about their decisions.

DYOR seems to be applicable beyond the crypto world – due to the amount of misinformation floating around, one needs to keep a keen eye on the sources, or get professional advice.