New Crypto Tax Bill Rattles US Crypto Companies

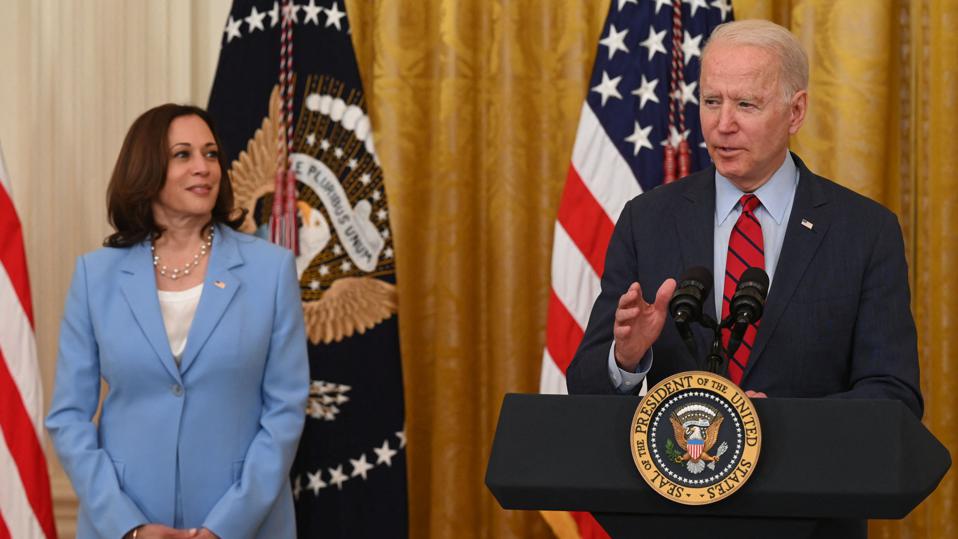

Lawmakers in the US and President Joe Biden have finalised the details for a US$1.2 trillion bipartisan package for infrastructure. Curiously, a number of provisions were included at the last minute, aiming to raise an estimated US$28 billion in tax revenue from crypto companies and digital assets.

Source: Forbes

“Once in a Generation” Investment in US Infrastructure

The bill is ostensibly intended to modernise the nation’s ailing infrastructure – from bridges, roads and shipping ports to high-speed internet and electric vehicles. And up until last week, the bill appeared to be on track to be passed with bipartisan support. That was until new provisions were inserted for crypto trading firms and brokers.

Crypto Regulation Provisions

As regulators around the world, from Australia through to South Korea, grapple with the world of crypto, the US’s position has thus far been largely accommodative, particularly in states such as Wyoming.

This particular federal bill, however, includes measures to increase tax enforcement, such as reporting requirements on exchanges and crypto brokerages. According to the bill, exchanges and crypto brokerages will be required to provide all details about cryptocurrency transactions equal to or more than US$10,000 to the IRS.

Critics Warn of Unintended Consequences

Critics say that the bill is rushed, impractical and bound to have numerous unintended consequences.

In an open letter by the Blockchain Association, the bill was described as “an imminent threat to the budding crypto industry here in America”.

What Congress is considering with this measure is not a new tax on the cryptocurrency industry. Instead, it puts new reporting requirements on individual players in the industry who have no way to comply.

Kristin Smith, executive director, the Blockchain Association

Smith went on to say market participants would be faced with impossible-to-fulfill reporting requirements that could thwart innovation in the sector and push these companies offshore. For that reason, she also expressed doubt that the bill would ultimately achieve its objective of collecting US$28 billion.

Instead of rushing through an untested provision with vast unintended consequences, we encourage Congress to work with our industry to find language that works for all stakeholders, keeping America at the forefront of crypto innovation.

Kristin Smith, the Blockchain Association

Jerry Brito, of Coin Center, said the draft language was “so broad” that it would add new reporting for many organisations that “have no visibility into users’ transactions”:

In a lengthy Twitter thread, Jake Chervinksy of Compound Finance offered a scathing breakdown of the bill and called it misguided. In it, he highlighted the excessively broad definitions, impact on DeFi, offshoring of innovation, the impossibility of compliance on some companies, and the potential impact on civil rights:

Aside from the practical issues highlighted above, venture capitalist Nic Carter took issue with the bill in principle. Commenting on the current administration’s apparent embrace of modern monetary theory (MMT), he said the notion of having to raise taxes to fund infrastructure made no sense: