Lido Finance Warns Leveraged Traders as Staked ETH Loses Peg

Lido Finance has warned leveraged traders they are at risk of liquidations as a surge in ‘Staked Ethereum’ (stETH) redemptions has caused it to lose its 1:1 peg with Ethereum:

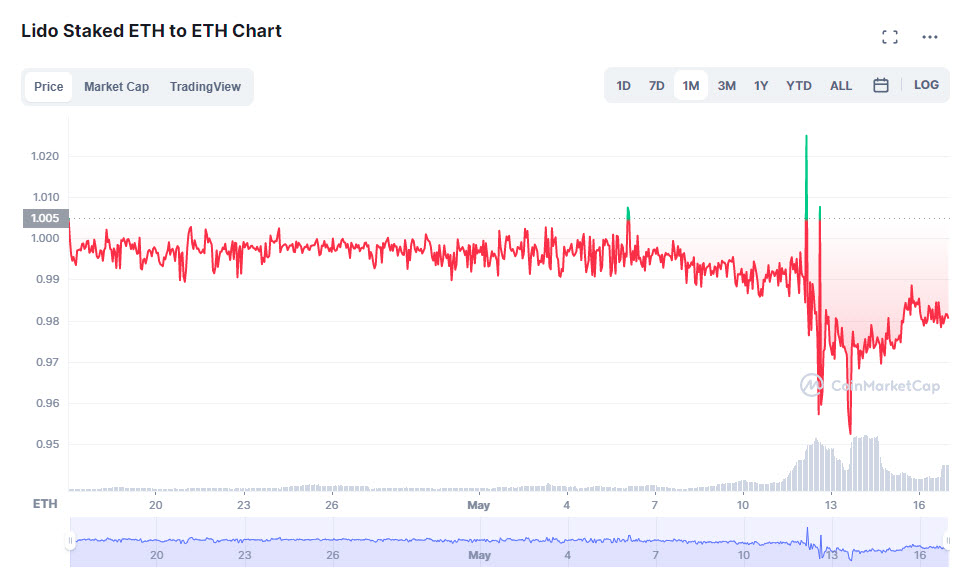

Discount Hits 5% Before Dropping Back to 3%

When Lido sent out its warnings, the discount was 4.2 percent and rose as high as 5 percent before dropping again. As it stands, 1 ETH can be exchanged for 1.0248 stETH through the Curve protocol, which means it is currently trading at a 3 percent discount relative to Ethereum.

Surge Follows Terra’s Lost Peg

The StETH price surged as people who have staked it in the Anchor lending protocol, which runs on the Terra blockchain, rushed to retrieve it on May 13 after the algorithmic stablecoin TerraUSD (UST) lost its peg to the US dollar.

Terra had also been paused twice, signifying an attempt by the team to save the network’s native assets as UST lost its peg. The fall of Terra has had widespread effects on the entire crypto industry – in this case, while the network was halted it would have been impossible for Lido users to recover their stETH.

Until stETH is trading at a discount, holders can redeem their stETH for more ETH compared to their initial deposits, meaning there would not be enough ETH in the pool to back all holders’ stETH.