Institutional Investors Currently Hold 30% of Bitcoin Supply

Since the last quarter of 2020, deep-pocketed Bitcoin investors have been increasingly adding more BTC to their portfolio. Following the current trends in the market, it doesn’t seem this buying momentum amongst institutions will calm down soon, according to Coinmetrics, a crypto-assets market data provider.

In the latest “State of the Network” report on Tuesday, Coinmetrics noted an increasing rate of accumulation with institutional BTC addresses holding between 1,000 to 10,000 Bitcoin.

Bitcoin Whale are Still Buying

Bitcoin supply held by these addresses increased significantly since last year. At present, these addresses account for about 30 percent of BTC supply in circulation.

Meanwhile, BTC addresses holding between 10 BTC to 1,000 BTC lost more supply within the same period, while addresses with lower Bitcoin (0 and 10 BTC) saw an uptick in supply share. Coinmetrics mentioned an “increase in BTC accumulation” as a possible reason behind this change in BTC supply distribution.

Per Coinmetrics, this change indicates that retail-sized investors are also accumulating more Bitcoin along with institutions, as new investors also enter the market. Bitinfocharts’ Bitcoin rich list shows that there are currently 2,403 addresses holding at least 1K to 10K Bitcoin. A total of 148,928 addresses are holding between 10 to 1K Bitcoin, while 680,804 holds at least 1 to 100 BTC.

ETH Shows Similar Growth with BTC

Bitcoin isn’t the only cryptocurrency seeing an increasing rate of accumulation. According to Coinmetrics, Ether (ETH), the second-largest cryptocurrency, sees a similar growth in the number of addresses holding more than 10,000 ETH, when compared to the increase in 1K BTC addresses.

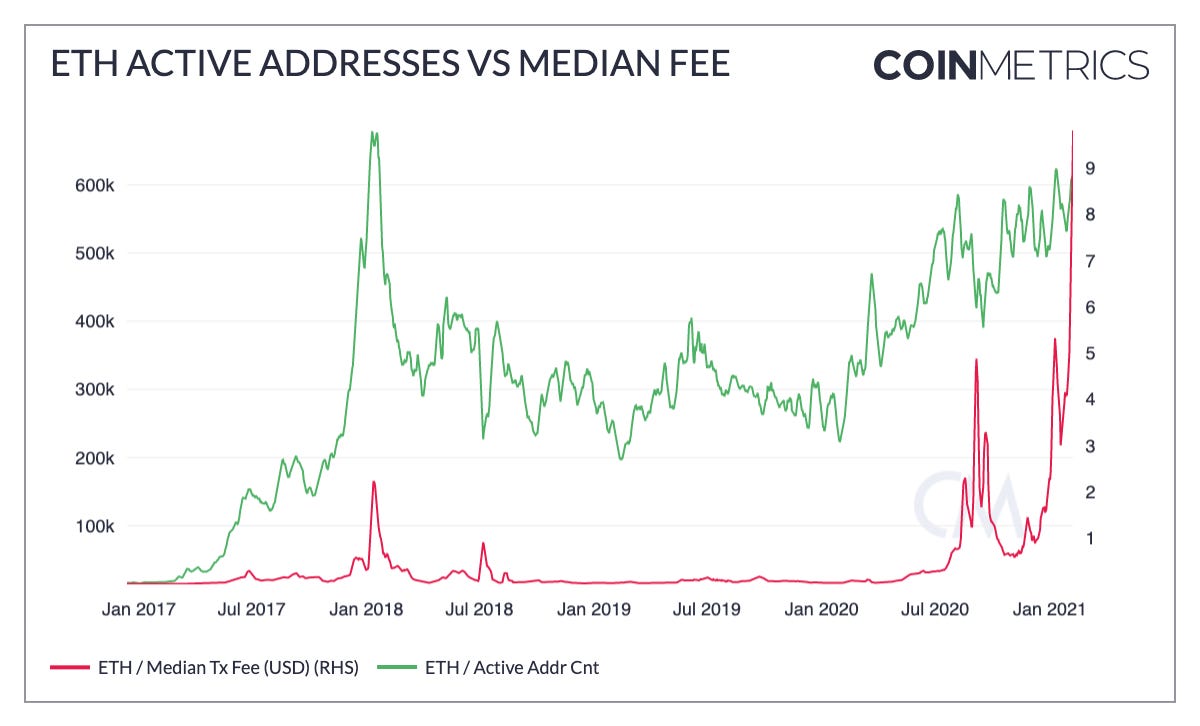

Also, the network activity on Ethereum has been on the increase since the start of the year. This is evident as the number of active ETH addresses has remained relatively high, averaging between about 550K and 600K a day, despite the high transaction fees.