What Are Tokenised Assets?

Envision a future where sending real world assets such as stocks, commodities and bonds is as seamless as texting. Instant, low-cost and permissionless. Gone are the days of high fees, slow settlements and tedious paperwork.

This is the transformative potential tokenisation holds.

But What Is Tokenisation?

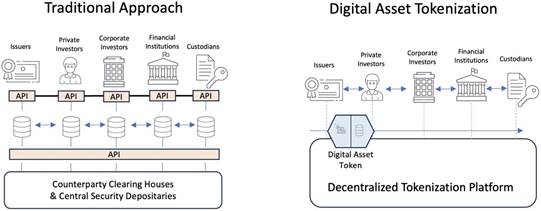

Tokenisation is the process of converting ownership rights, or the value, of a real world asset (RWA) into a digital token, most commonly on smart contract platforms such as Ethereum. This enables users to gain immutable ownership of real world assets on-chain, streamlining the process of ownership and transfers for investors.

The Benefits of Tokenisation

There are two core advantages to tokenising assets: accessibility and velocity.

Accessibility

Tokenisation lowers the barrier to entry for markets by allowing a global investor base to purchase small fractions of high-value assets. This democratises investment opportunities while simultaneously driving liquidity into previously illiquid assets such as fine art. In practice, this means investors with lower capital can buy, for example, one token representing 1/100th of a million-dollar painting, Best of all, buyers don’t need to worry about transport, storage or time zone differences thanks to 24/7 global, digital markets.

Additionally by tokenising fiat currencies into stablecoins (like USD), underserved populations such as the unbanked or those in regions with volatile local currencies receive easy, borderless access to a more reliable store of value and medium of exchange.

Velocity

Tokenising assets enables cheap and fast transfers while unlocking composability with other crypto assets. This helps move money more efficiently, combining funds that were previously scattered across different systems and couldn’t be used effectively.

Perhaps one of the greatest advantages of tokenisation is that it allows assets to become composable within decentralised finance (DeFi) and fully programmable through smart contracts. This enables countless use cases that enable capital efficiency, such as being able to permissionlessly draw a loan against your tokenised asset with blazing fast speeds and no paperwork.

The Current Tokenisation Ecosystem

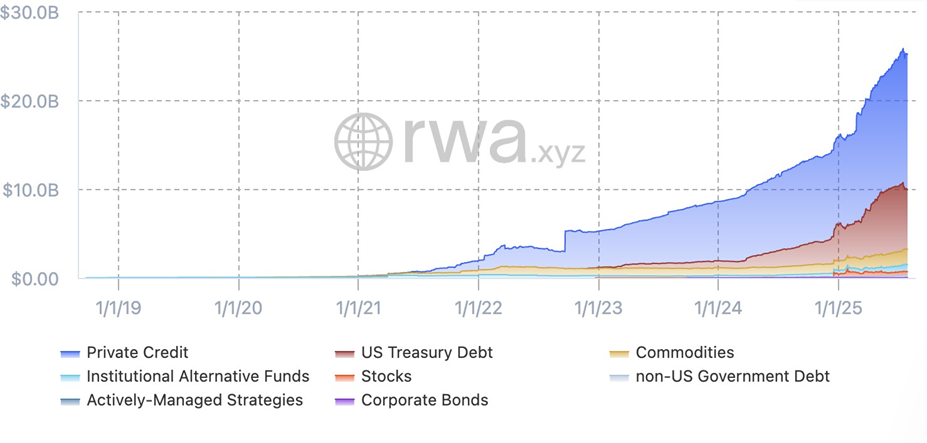

The RWA ecosystem has seen tremendous growth globally this year with the total RWA value (excluding stablecoins) increasing ~60% year-to-date from US$15.76 billion to US$25.13 billion, marking a breakout year for nominal growth.

This growth has been fuelled by three primary factors:

- Greater regulatory clarity and a pro-tokenisation stance from the U.S. SEC

- Rising institutional adoption by traditional finance heavyweights

- The foundational role of stablecoins as enablers of on-chain asset flows Some of the leading categories, assets, and issuers include:

Tokenised Treasuries:

BUIDL – BlackRock

- Launched in March 2024, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) has quickly become the largest tokenised fund and the largest tokenised

asset by market cap (excluding stablecoins). Managed by the world’s biggest asset manager, BUIDL invests exclusively in US Treasury bills and repurchase agreements. It aims to maintain a $1 token value while paying daily yield directly to holders’ wallets via on-chain dividends. Currently available only to qualified investors, BUIDL has seen strong demand from DeFi protocols and stablecoin issuers seeking real-world yields, as well as institutions looking for regulated on-chain yield.

Other Tokenised Treasury Products:

Following BUIDL’s lead, several other players have entered the market with similar offerings. Notable examples include:

- BENJI by Franklin Templeton

- OUSG and USDY by Ondo Finance

- JTRSY by Janus Henderson

These funds bring traditional fixed-income assets into the digital realm, enabling 24/7 liquidity and programmable yield distribution.

Tokenised Commodities:

PAXG & Tether Gold (XAUT)

- Tokenised gold is another large market transitioning on-chain, with Paxos’ PAXG and Tether’s XAUT leading the market. These tokens digitally give users price exposure to gold, combining the stability of a traditional safe haven asset with the benefits of crypto rails. So far, no other commodities have seen meaningful uptake within the tokenisation space.

Gold’s popularity as an asset means there are many liquidity and storage solutions for investors via third-party custodians. However, the fees associated with these solutions can be expensive – especially for smaller transactions.

Tokenised Equities

Backed Finance, Kraken & Robinhood

- Momentum is building in the tokenised equities space. Platforms such as Backed Finance, Kraken and Robinhood have begun experimenting with tokenised stock offerings, making traditional equities more accessible to on-chain users. The obvious advantage here is timing – stocks are typically only purchasable during trading hours. Tokenising them allows investors to trade international equities at any time.

Institutional Funds & Actively Managed Strategies

Tokenisation isn’t limited to passive assets. In 2024, tokenised institutional funds and actively managed strategies have grown ~143% year-to-date.

Securitize leads this space by providing the infrastructure powering a significant portion of the tokenised asset ecosystem. Other fast-growing players include:

- Plume: An RWA-focused Layer 1 network

- Midas: A tokenisation platform enabling permissionless access via instant minting and redemption

The Regulatory Landscape in Australia

Stablecoins act as a vital bridge between traditional fiat currencies and the crypto ecosystem. As tokenised representations of fiat, most commonly the US dollar, they allow users to access the benefits of digital assets (such as 24/7 transferability and composability) while minimising volatility by pegging their value to a stable value. These assets enable near-instant settlement and low-cost transfers compared to legacy financial infrastructure.

Australia has been actively exploring the utility of stablecoins in the context of Central Bank Digital Currencies (CBDCs) for wholesale financial operations. Project Acacia, led by the Reserve Bank of Australia, aims to tokenise asset markets to improve the efficiency, transparency and resilience of interbank settlements. Unlike privately issued stablecoins, CBDCs are issued and regulated by central banks, functioning like digital versions of the nation’s physical cash.

Looking ahead, the Australian government plans a sweeping regulatory overhaul in 2025 to integrate digital assets into the economy with appropriate safeguards. Largely inspired by the EU’s Markets in Crypto-Assets (MiCA) framework, the reform package will focus on four key areas:

- Establishing a licensing framework for Digital Asset Platforms (DAPs) that custody digital assets on behalf of consumers

- Creating a regulatory regime for payment stablecoins, to be treated as Stored-Value Facilities (SVFs) under the broader Payments Licensing Reforms

- Conducting a review of the Enhanced Regulatory Sandbox to facilitate safe experimentation in fintech and crypto

- Launching a suite of initiatives/research aimed at unlocking the potential of digital asset technologies, including: tokenisation, DeFi and CBDCs across financial markets and the broader economy

The Treasury’s report also highlights concerns around de-banking – where crypto businesses or individuals with strong ties to crypto have been denied access to traditional banking services.

Conclusion

Tokenisation is seamlessly merging real-world assets with blockchain’s efficiency, accessibility and innovation. From democratising investment through fractional ownership and enhanced liquidity to unlocking composability in DeFi, the benefits are reshaping global markets. In Australia, discussions around progressive regulatory reforms are beginning, including frameworks for both the support of private stablecoins and wholesale CBDCs, signalling a supportive path forward, potentially heralding safer integration of digital assets into the economy. As adoption accelerates, tokenisation not only bridges traditional finance and crypto but also paves the way for a more inclusive, borderless and programmable financial future.