Top 5 Bitcoin Alternatives 2022 & Where to Buy Them

Bitcoin has experienced a massive surge in value over the last couple of years, reaching an all-time high of 90,000 AUD in 2021 and catapulting cryptocurrency into the mainstream media. Despite this dramatic increase in popularity and adoption rates, there are still many issues left unresolved with the Bitcoin network.

While Bitcoin may be the undisputed champion of the cryptocurrency arena, there are more than 1,300 different digital currencies, crypto coins and tokens that are currently being traded on the cryptocurrency markets. While most of these altcoins are either redundant or highly niche-specific, there are few key cryptos that present cryptocurrency investors with viable and potentially promising Bitcoin alternatives.

What’s Going Wrong With Bitcoin?

Satoshi Nakamoto, the mysterious creator of Bitcoin, originally devised the cryptocurrency as a “peer-to-peer electronic cash system” that would revolutionise, democratise, and decentralise the current international financial paradigm. The massive increase in popularity and value that Bitcoin has experienced over the past year, however, has left the Bitcoin network slow, unwieldy, and far from this original objective.

The core issue with the Bitcoin network at this point in time is a specific parameter called “block size limit”. The “block” in “blockchain” refers to a cryptographically encoded list of all transactions that have occurred over the network in the previous 10 minutes. In 2010, the size of each block was limited to 1 megabyte in order to prevent hacking attacks, but with the massive increase in transaction frequency that has occurred recently, this block size limit is now crippling the Bitcoin network.

Bitcoin Transaction Frequency Since Inception Courtesy of Blockchain Luxembourg S.A.

The 1 megabyte block size limit means the Bitcoin network can only support a potential maximum of seven transactions per second, which means transactions can sometimes take as long as 24 hours in average transaction times or longer to complete during peak periods.

Bitcoin network participants that help process transactions will treat transactions with higher fees as high priority, resulting in transaction fees as high as $55 USD in January 2017. There are a number of solutions that aim to solve these issues, such as the Lightning Network layer, but these developments present their own unique issues.

The birth of the Lightning mainnet can be viewed live as a new layer grows organically on top of the Bitcoin network. For comparison, it’s possible to view a 3D live visualisation of the current Bitcoin Network on Bitnodes. The nature of the Lightning Network solution, however, means that the network will be centralised around major hubs as illustrated in the visualisation below:

Lightning Network Testnet Visualisation Courtesy of Steven Roose.

Centralisation is antithetical to the core tenets of blockchain technology, so there is an understandable amount of controversy within the Bitcoin and blockchain community as to whether the Lightning Network will solve the issues that plague the Bitcoin network at this point in time.

The high value of Bitcoin has also led many investors to “HODL”, a humorous acronym derived from a typo in a Bitcointalk Forum post in 2014 that refers to “holding on for dear life”. Many investors purchase Bitcoin in order to use it as a method of storing value, not for use as currency, promoting hoarding.

Lastly, the extreme surge in Bitcoin popularity has captured the attention of regulatory bodies around the world. The Australian Transaction Reports and Analysis Centre (AUSTRAC) has recently been provided with new powers to investigate Bitcoin traders, while new legislative amendments force crypto exchanges to disclose user information. As a result, more Australian crypto traders are seeking privacy-focused cryptocurrencies.

Fortunately, there are many highly innovative high market cap cryptocurrencies that have the potential to challenge Bitcoin as the de facto king of cryptocurrency. We’ll now proceed to examine the best Bitcoin alternatives for 2018 and find out what makes them prime competitors:

Litecoin (LTC)

Market Cap: $9.33 Billion

Litecoin is a rising star in the cryptocurrency ecosystem and is focused heavily on facilitating seamless day-to-day payments. Created by Charlie Lee, a former Google thought leader, Litecoin has dramatically increased in popularity since the third quarter of 2017.

Litecoin has maintained a position in the top 10 highest market cap cryptocurrencies for several months now, and is designed with practicality in mind. Lee, speaking at a Coinbase talk in March 2017, elaborated on his vision for Litecoin:

“Bitcoin can be used for like moving millions of dollars between banks, buying houses, buying cars. It’s really secure … Litecoin can be used for cheaper things.”

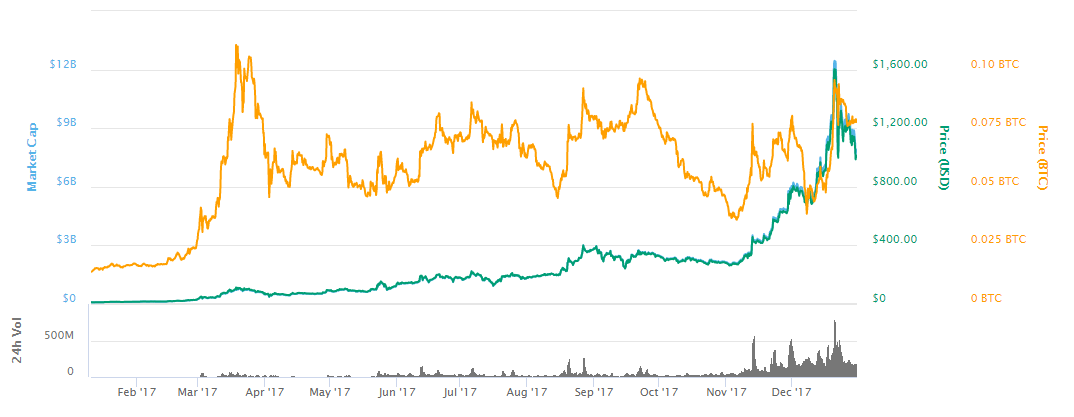

Litecoin performance over 2017 courtesy of CoinMarketCap.com

Litecoin Features:

The technological architecture behind Litecoin allows it to offer significantly faster transaction times than Bitcoin – more than 400% faster. Litecoin also offers a total cap of 84 million individual coins, which makes it more viable as a daily payment system.

One of the most important differences between Litecoin and Bitcoin is the hardware required to participate in mining. Litecoin implements the Scrypt algorithm for cryptographic encryption, which requires less specialised hardware than Bitcoin’s SHA-256 algorithm. This difference could draw more network participants in assisting with network maintenance, speeding up overall growth.

Why buy Litecoin?

With a lower barrier to entry for mining, faster transaction speeds, and a lower per-unit cost, Litecoin is a solid alternative to Bitcoin. With Charlie Lee announcing an upcoming marketing campaign, now could be the ideal time to get on board the Litecoin hype train.

Where to Buy Litecoin:

- Swyftx makes it possible to purchase Litecoin via POLi, BPAY and Cash.

- > Click here to get started with Litecoin on Swyftx

- Coinbase allows Australian traders to purchase Litecoin with credit and debit cards.

- > Click here to get started with Litecoin on Coinbase

Bitcoin Cash (BCH)

Market Cap: $25.78 Billion

Bitcoin Cash is a “fork” of the original Bitcoin blockchain ledger. Launched in July 2017, Bitcoin Cash was created when a team of developers decided they would improve upon the Bitcoin core by increasing block size and implementing a number of other changes. This split is referred to as a fork in the blockchain ecosystem.

The primary goal of Bitcoin Cash is to improve transaction times and lower transaction fees by increasing the size of each block to 8 megabytes instead of just 1. Bitcoin Cash, or BCH, has been a highly successful cryptocurrency since launch. The price of BCH jumped dramatically to around $2,000 in November 2017 when a proposed fix called “SegWit2x” that was intended to resolves issues in the core Bitcoin blockchain failed.

The value of Bitcoin Cash almost doubled to $4,000 in December 2017 when highly popular platform Coinbase announced its support of the coin. Vinny Lingham, who is referred to as the “Bitcoin Oracle”, has stated that he believes Bitcoin Cash will surpass Bitcoin as the number one cryptocurrency:

“The one need is global fast cheap payments … When I look at it from a products standpoint I think the greater demand is for peer-to-peer cash than for digital gold.”

Bitcoin cash performance over 2017 courtesy of CoinMarketCap.com

Bitcoin Cash Features:

The higher block size of Bitcoin Cash allows the network to resolve more than 50 transactions per second, which dominates the 7 transaction per second limit in place with Bitcoin. Bitcoin Cash transaction fees are also significantly lower, with fees averaging around $0.001. Transactions on the Bitcoin Cash network are currently taking just 10 minutes to resolve.

Why Bitcoin Cash?

Bitcoin’s Lightning Network layer may claim to provide faster transaction times and lower fees, but Bitcoin Cash is already delivering on these promises. If the Lightning Network layer fails to succeed in addressing the issues that plague Bitcoin, then it’s likely Bitcoin Cash could depose Bitcoin as king of the digital currency world.

Where to Buy Bitcoin Cash:

- Swyftx allows Australian traders to purchase Bitcoin Cash with credit and debit cards.

- > Click here to buy Bitcoin Cash on Swyftx

Ethereum (ETH)

Market Cap: $107.91 Billion

Ethereum is the second-largest cryptocurrency by market capitalization, and is vastly different to Bitcoin in many ways. Created by Vitalik Buterin in 2013, Ethereum has exploded over the past year, increasing in value by more than 12,500 percent.

While both Bitcoin and Ethereum are based on blockchain technology, Ethereum is far from a simple cryptocurrency. Ethereum is a blockchain platform, using “Ether” as a currency token. Ethereum is designed to function as a blockchain platform that enables the creation and execution of “smart contracts”, which are immutable programs executed on Ethereums blockchain networks that control the transfer of cryptocurrency or other digital assets.

Ethereum is often described as the “World Computer” – it can be used to create decentralised applications that manage energy distribution, decentralise digital marketing, or even allow users to share their computer’s processing power in a vastly distributed supercomputer.

Ethereum creator Vitalik Buterin has elaborated on the highly flexible and scalable nature of the Ethereum blockchain:

“You could run StarCraft on the blockchain. Those kinds of things are possible. High level of security and scalability allows all these various other things to be built on top.”

Ethereum performance over 2017 courtesy of CoinMarketCap.com

Ethereum Features:

The Ethereum network is currently able to handle around 15 transactions per second, or TPS. Recent comments made by Buterin, however, reveal that the Ethereum blockchain will soon rival Visa, at around 2,000 TPS.

Ethereum is a highly flexible, dynamic and intelligent blockchain platform that is far more functional than Bitcoin, and is currently the driving force behind the most disruptive blockchain-based projects currently under way.

Why Ethereum?

Bitcoin may be the highest-value cryptocurrency, but Ethereum is most definitely here to stay. Ethereum-standardised tokens, or “ERC20” tokens, are used in most initial coin offerings – a technique used by blockchain startups to generate seed capital outside of traditional VC sources.

Ethereum is also set to switch from the energy-intensive “proof of work” consensus method that is currently used in Ether mining to a faster, cheaper and more accessible “proof of stake” method.

Where to Buy Ethereum:

- Swyftx is a secure Australian exchange that allows traders to trade, sell and earn interest on ETH. > Click here to start investing in Ethereum with Swyftx

Stellar Lumens (XLM)

Market Cap: $9.03 Billion

Stellar Lumens is a blockchain network that is specifically about “cross-asset transfers of value”. Simply put, Stellar is focused on lowering the cost of transferring assets, such as currency, between individuals.

While Bitcoin has the same fundamental purpose, Stellar is a decentralised, hybrid blockchain that is geared towards streamlining monetary transactions. Stellar Lumens, or XLM, make transactions cheaper, faster and more reliable. However, XLM offers less functionality as a method of storing value when compared to Bitcoin.

Stellar performance over 2017 courtesy of CoinMarketCap.com

Stellar Features:

Stellar Lumens addresses three primary issues with the current asset transfer paradigm – high transaction costs, slow settlement times, and a lack of liquidity in lesser-used currencies. Stellar Lumens solves these issues by charging a fee of 0.00001 XLM for each transaction. At current market rates, it would be possible to process 100,000 transactions for just under $0.50 USD.

Stellar network transactions are processed within less than 4 seconds, which makes it the fastest network online. As XLM can be used as a bridging currency, it dramatically increases liquidity and makes exchanging lesser-known currencies cost-effective and easy.

Why Stellar Lumens?

Stellar has recently announced partnerships with IBM, Deloitte, and Stripe, making it a highly attractive cryptocurrency to those interested in tokens that integrate with existing financial systems.

Where to Buy Stellar Lumens:

Buying XLM can be a little trickier than purchasing other cryptos in this list. You’ll need to obtain some cryptocurrency to trade for XLM, or get started with an exchange that supports fiat deposits.

Swyftx is one of Australia’s top crypto exchanges with over 300 available cryptocurrencies including XLM. Check out our Australian Exchange Guide to learn more about Swyftx and other Australian exchanges.

Dash (DASH)

Market Cap: $5.61 Billion

Dash is another top ten market cap cryptocurrency and, like Litecoin, is focused on addressing the issues of scalability that are currently troubling the blockchain network. Dash is the brainchild of Evan Duffield and is a Bitcoin fork, but unlike Bitcoin Dash it is heavily focused on protecting the privacy of users.

Since launch in 2014, Dash has experienced a dramatic increase in value. If you invested just $1,000 in Dash at the 2014 price of $0.03, you’d now be sitting on a wallet holding more than $25 million USD worth of the privacy-focused cryptocurrency.

Dash performance over 2017 courtesy of CoinMarketCap.com

Dash Features:

On the Bitcoin blockchain, it’s possible for anybody to see which wallets are sending how much Bitcoin and where. Dash uses a complicated anonymisation strategy called coinjoin mixing that obfuscates transaction ownership by processing the transactions of multiple parties as one single transaction. This process makes it impossible to determine who received funds, who sent them, or the amount transferred.

This anonymisation technique does slow down transactions per second rates somewhat but still allows Dash to process around 48 TPS, which is 7 times faster than Bitcoin. Dash also offers a much more attractive transaction fee, with an average of $0.10 per transaction.

Why Dash?

The highly secure, private and anonymous nature of Dash could make it a major competitor to Bitcoin as regulatory authorities around the world and within Australia tighten their grip on the explosive cryptocurrency market.

Where to Buy DASH:

- You can use Swyftx Crypto Exchange to purchase Dash by funding your trading account with AUD via bank transfer, and credit/debit card payments.

Final Thoughts

Bitcoin may be struggling through some growing pains as the network matures, but it’s still the most valuable and widely used cryptocurrency in the world. The upcoming Lightning Network implementation may provide Bitcoin users with a solution to Bitcoin’s scalability issue.

However, it is always important to diversify your portfolio when cryptocurrency investing to increase your exposure in the crypto market. That is why it is important to gain an understanding of other alternatives to bitcoin.