Top 7 Crypto Demo Accounts in Australia

If you’re curious about crypto but slightly overwhelmed by the possibilities of the market, a crypto demo account can be the perfect starting point. Demo trading, also called paper trading, is the practice of utilising simulated funds to try your hand at cryptocurrency trading without the attached risk from a real transaction.

Jumping headfirst into crypto trading, as a beginner, can significantly increase your chances of losing money. Therefore, it is imperative that every trader is aware of the risks associated with the market, and that they are prepared to make smart financial decisions. With the crypto market known for its volatility, a crypto demo account provides the perfect ‘safe space’ to learn crypto trading and experiment with different trading strategies.

There are multiple demo crypto and bitcoin trading accounts on offer for those looking to experience the market. This page will cover the tips, tricks, and benefits of demo trading, alongside an introduction to some of the best crypto demo accounts in circulation.

What is crypto demo trading?

Crypto demo trading is an exercise designed to offer a trader the opportunity to gain exposure to market conditions and practice trading without risking their own money. When you begin your demo, you will receive a sum of artificial money that you can put towards buying, selling, and trading cryptocurrency. A virtual account is typically linked to real market data, meaning that not only can these accounts be useful for crypto beginners, but they also provide the perfect opportunity for more experienced traders to try various strategies.

Demo accounts can be found on numerous trading platforms and crypto exchanges. Not all crypto practice accounts are available for free; however, most will be. Each platform will vary in terms of usability, available trading tools and crypto pairs, and beginner-friendliness.

Checkout our top crypto exchanges comparison.

Benefits of Crypto Demo Trading

There are several benefits associated with demo trading. Not only are these practice accounts excellent for helping beginner investors find their feet within the market, but they also provide the perfect environment for experienced traders to trial trading strategies. Put simply, the benefits of crypto demo accounts are that they can be:

- Great for beginner traders,

- Helpful for the development of trading strategies, and

- Ideal for building skills that may reduce financial risk.

- Access to advanced trading tools

Important to remember: Experimenting with a free demo account does not substitute thorough investment research. These accounts serve to allow traders to put their research to the test. Ensure you are knowledgeable about the trading you wish to partake in, and then utilise a demo account to build on this.

Best crypto demo accounts

Unfortunately, most crypto exchanges and trading platforms don’t offer a demo mode. However, there are still several options available to Aussies. The following will be a comprehensive list of all the best demo accounts, to help simplify your decision.

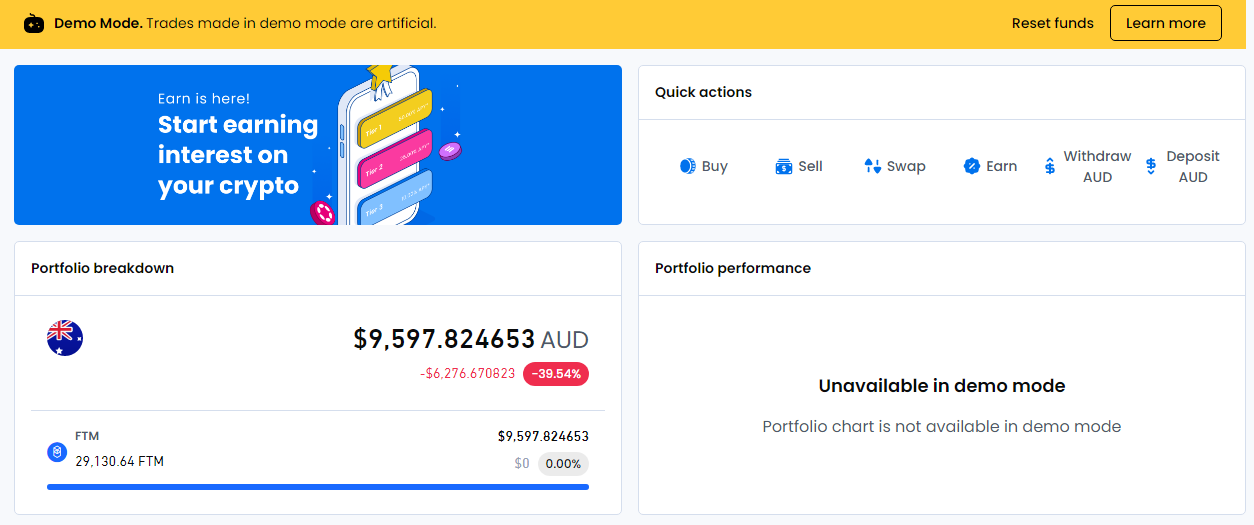

1. Swyftx

Swyftx demo mode is beginner-friendly, prioritising ease of use and allowing traders to imitate most of the trading features Swyftx has to offer. Swyftx demo mode is quite intuitive and designed to mimic its real-world trading platform. Therefore, any potential confusion a trader might experience when switching Swyftx’s actual trading platform is removed. As the demo platform is aligned with the live platform, users can access features such as:

- Price alerts,

- More than 310 tradable assets,

- Market depth and global liquidity,

- Portfolio progress tracking,

- Mobile and desktop applications, and

- Live market trends

Every Swyftx demo account is credited with $10,000 USD of virtual funds, called ‘Mock Currency’. The balance cannot be added to once the account is opened; however, the customer support team can reset your Swyftx demo trading mode upon request. These funds can be used to buy, sell and trade BTC, ETH, XRP, DOGE, ADA and hundreds more.

Creating a Swyftx demo trading account

It couldn’t be easier to get started with a Swyftx crypto demo, all you need to do is:

- Create a Swyftx account: Sign up to the exchange using your name, email address, and phone number.

- Switch your account to ‘demo mode’: You’ll find the switch at the top right side of your screen. Once you switch, a yellow banner will show at the top of your screen to indicate that you’re in demo mode.

- Begin trading: Your mock currency will be credited, and you are then ready to start experimenting with the market.

It is important that you see the yellow banner if you are intending to trade crypto using the demo mode. If you’d like to trade with real-market data and zero financial risk, a Swyftx demo account might be right for you.

2. eToro

Trading platform and global financial brokerage, eToro, offers one of the more comprehensive demo accounts. Notably, the eToro demo mode permits its users to trade across a much broader range of markets, including stocks, commodities, currencies, indices, ETFs, and crypto. eToro’s demo crypto trading account grants traders $100,000 in artificial funds to put towards the development of a virtual portfolio.

Aside from Bitcoin demo trading, eToro allows users to select from 15 other cryptocurrencies for their mock transactions. Additionally, a standout feature for the eToro demo is the ‘social trading news feed’. This is the perfect space for interaction with other traders, offering you the opportunity to share your strategies or learn from others. Whilst you should not blindly follow a strategy without conducting your own research, this can be a great way to learn from more experienced traders. This social platform can be sorted by ‘popular investors’, thereby giving you direct access to the strategies of successful traders.

Creating an eToro demo account

1. Create an account with eToro by providing your email address and creating a secure username and password.

2. Access your ‘Virtual Portfolio’: Under your username, you will be presented with a dropdown. Click ‘Virtual portfolio’ which will take you to your demo account.

3. Begin trading: Your artificial funds will be deposited, and you are ready to begin to practise trading with real-time market data.

The eToro demo account enables traders to follow each investment’s real-time trends thanks to advanced analysis tools. Traders can also experiment with applying leverage, Stop Loss, and Take Profit features. eToro also lets its customers access ready-made thematic portfolios for further ease of use.

3. Binance

Crypto’s biggest exchange, Binance, calls its demo trading account ‘Mock Trading’; this can be found under Binance Futures trading. Futures is a more speculative trading style that involves trading derivative contracts at a set future price and date. The simulation trading platform is less accessible than other demos; however, as Futures trading is quite risky, learning without financial commitments can be very valuable.

Once you open your Binance Futures testnet (demo) account, you are credited 3000 USDT which is the equivalent of $3000 USD. Your virtual portfolio will permit you to utilise up to 25x leverage, place stop-losses, and take profit orders. The testnet also allows traders to adjust the risk level, providing an opportunity for investors of all calibres to grow. This demo account can additionally be accessed on mobile. Note that the Mock Trading environment’s candlestick charts and prices may differ from the market value.

Creating a Binance Futures demo trading account

- Register or log in to your Binance account: You will require your full name, email address, and phone number.

- Confirm a Binance Futures account: Under the profile icon in the top right corner, click ‘Mock Trading’ and confirm your intentions to make a Binance Futures testnet account.

- Start trading: Experiment with trading futures.

Note that one negative aspect of the Binance demo account is that it does not cater to spot trading.

4. TradingView

The charting and social networking site, TradingView, was initially focused on stock scanning and charting. However, the site recently bridged into cryptocurrency and now monitors the historical prices of trading pairs across a variety of markets. Studying historical prices and conducting technical analysis can be useful for identifying patterns that may translate to the future price movements of assets. TradingView is not an exchange; therefore, users cannot deposit and trade with real currency. However, TradingView does offer demo crypto trading, permitting its users to learn from its advanced charting system.

TradingView calls its demo crypto account ‘Paper Trading’ and primarily caters to more advanced traders who seek to utilise a variety of charting tools to expand on their existing knowledge. Some of the key features of a TradingView crypto demo include:

- Real market data from multiple exchanges

- Price alerts and other indicators per chart

- Trading strategy simulations and result measurements

- Hundreds of trading pairs

Creating a TradingView demo trading account

- Create an account: Once you have an account with TradingView, select ‘Paper Trading’ under the trading panel.

- Start trading: To get started all you need to do is right-click on your chosen chart, hover your cursor over ‘Trade’, then click ‘Create New Order’ and you are ready to begin.

5. Plus500

Plus500 is notably one of the top-performing Contract for Difference (CFD) trading platforms. CFD means that traders are investing in financial products which track the prices of assets such as stocks, indices, Forex, ETFs, and cryptocurrencies. Due to this, any funds you invest in crypto, cannot be withdrawn to an external wallet. Plus500 is especially good for beginners, as it can teach aspiring traders the ropes. The interface is easy to use, and the ‘order entry window’ summarises useful trades for beginners using the demo crypto account.

Demo users can trade their CFDs with up to 30x leverage and can use artificial funds to trade with 17 different cryptocurrencies. Thanks to its functionality, Plus500 allows seasoned traders to practice high-risk trades. Tutorials can be accessed to guide beginner traders, and customer service is available at any time. Once you feel that you have had enough practice under your belt, the process of switching back to live trading is simple.

Creating a Plus500 demo trading account

- Activate a demo crypto account: You do not need to open a real trading account to begin a demo; instead, when you reach the registration window click ‘Select Account Mode’ and sign up for the Demo Mode.

- Complete the tutorial: The tutorial will guide you through the functionalities of the platform and teach you how to place trades.

Note that if the sum of your artificial funds drops under $200, your balance will be reset.

6. BitMart

BitMart is known for its multiple interesting features, including trading futures, crypto lending, and staking. Its demo crypto account interface almost perfectly matches its live trading interface and gives users access to integrated TradingView charts, which offer a range of technical indicators to assist with trading strategies. The user interface does have some slight variations in appearance for its futures markets, as to include the leverage options.

The practice account supplies a practice amount for the purchase of cryptocurrencies. And, whilst most live features can be accessed on the demo, switching to live trading offers multiple features, including:

- Futures market trading with leverage up to 100x

- Spot market trading with more than 90 crypto pairs against BTC, BMX, USDT, and ETH tokens

- Lending on digital assets, with the potential to earn crypto interest up to 6.25% APY

- Mobile app access for trading and monitoring your portfolio.

7. Bitsgap

Bitsgap is a trading platform with several valuable features, such as allowing users to manage multiple portfolios, trade multiple digital assets, and access trading bots. Integrated with 25 of the biggest global cryptocurrency exchanges (such as Kraken and Coinbase Pro), Bitsgap’s demo account (https://bitsgap.com/demo-trading) has access to all the features on its live trading platform. The demo account operates by replicating its supported exchange’s order books, offering traders the opportunity to:

- Utilise the Smart order options and risk management tools to create safe investment strategies

- Allow trading bots to trade for you when offline

- Practice trading with multiple order types

- Monitor portfolio profits and losses

Creating a Bitsgap demo account

- Sign up or log in: The Bitsgap site can be easily navigated to register or log in.

- Switch to the demo: You can enable Demo mode under your profile in the top right corner of your screen. You must make sure that the status is changed to ON.

- Try it out: The Bitsgap Demo FAQ section provides a list of things it recommends beginners try if you aren’t sure where to begin.

Once your account is up and running you will receive 10 (demo) Bitcoin. This Bitcoin demo trading will help you to polish your trading skills at your own pace.

Tips to make demo trading more realistic

The primary aim of utilising demo trading is to learn in the most realistic scenario imaginable, without the attached financial risk. Therefore, to ensure you achieve this goal, we have compiled some tips to make sure your experience is as practical as possible.

1. Pretend it’s real money

If you can successfully disassociate from the notion that demo trading is fake, and instead pretend the funds you use are real, you are more likely to learn from the experience.

Moving into a demo experience fully committed to the concept that you are using real money, limits the chances of you making reckless decisions you might otherwise avoid. The downside of a demo account is that, for some, removing the risk also removes the commitment to learn the basic fundamentals of crypto trading. Therefore, pretending that all the financial risk remains, will likely prompt you to make smarter decisions, and you will thereby take more from the opportunity.

2. Account for slippage

The difference between the value of an asset when an order is placed, and its value when the order is fulfilled, is called slippage. Slippage can result in either a loss or a gain, and it is imperative that you take this into account in both a crypto demo and live trading.

You can work on accounting for slippage in your demo trading by:

- Utilising a limit order

- Determining your slippage tolerance

- Using strategies (i.e. dividing one large order into multiple smaller ones)

Consider slippage when choosing the exchange you will eventually live trade with, as some exchanges have more features to aid with this than others.

3. Make high-volume trades that you wouldn’t normally make

Whilst you should do your best to pretend that your demo crypto account trading is real, don’t neglect the fact that you can experiment with the volume of your trades. Making higher volume trades that you might traditionally avoid in the real market is a great way to play with the concept of risk and reward.

At the end of the day, demo accounts create a safe environment for you to test your ideas and develop new strategies!

4. Research an asset before investing

Just because you have experimented with the best crypto demo accounts, and the real assets that you are interested in, does not mean you won’t require further research. Any investment you make, whether crypto-related or not, should be supported by in-depth research and understanding.

Once you switch to live trading the risk is real and making reckless trades without conducting thorough research can end up costing you.

Key Takeaways: Simulated trading is designed to offer you the opportunity to experiment with the market without fear of financial loss. There are multiple demo accounts on offer to suit traders of all experience levels. You can utilize these accounts to learn or test strategies; however, demo experimentation will never substitute quality investment research.