How To Get A Crypto Backed Loan With Binance

A Bitcoin backed loan this is similar to any other loan, however with this type of loan you can borrow Cryptocurrency and use your existing Bitcoin as collateral against the borrowing.

This crypto loan is provided by Binance and you can use your existing Binance account to apply. All registered Binance users can apply without any lengthy forms to fill in, and what’s best is that it’s approved instantly.

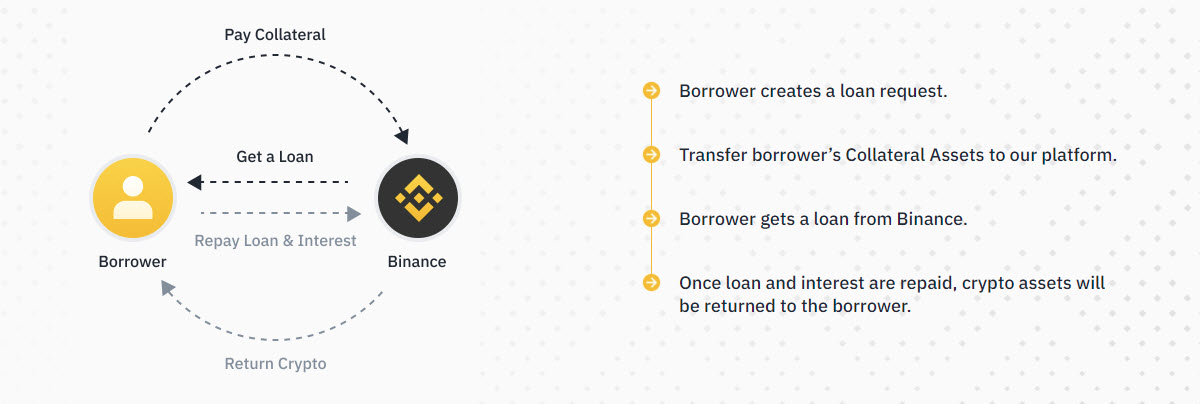

How A Crypto Backed Loan works

The process is simple – you lend your Bitcoin to Binance for a specific amount of time (say 30 days) and in return they lend you crypto. You pay hourly interest for the loan in Bitcoin. If the price of Bitcoin drops suddenly, you can simply top up your loan collateral to keep the amount borrowed to below 65% to avoid your loan being liquidated.

- Coin Borrowed = The crypto that you borrowed from the loan.

- Collateral Coin = The crypto that you used to fund for the loan.

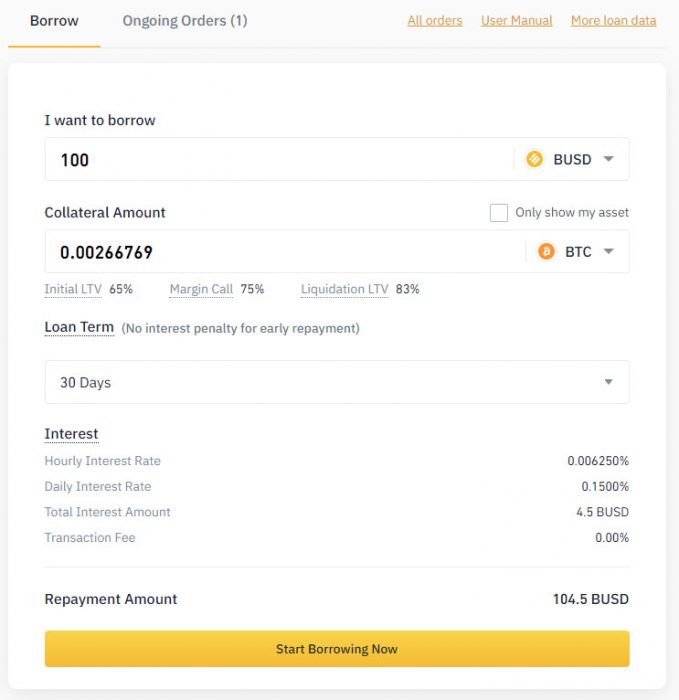

In the example below we are borrowing $100 USD worth of BUSD for 30 days and using Bitcoin (BTC) to fund the loan as crypto collateral. BUSD is a stablecoin like USDT, but it is run by Binance.

Steps to Apply for a Bitcoin Backed Loan

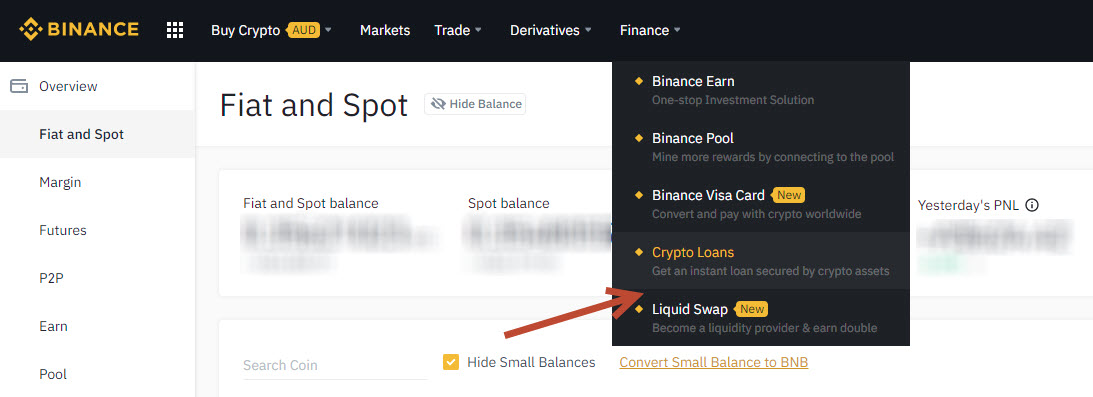

- Login to your Binance Account

- Select Finance > Loans from the main menu

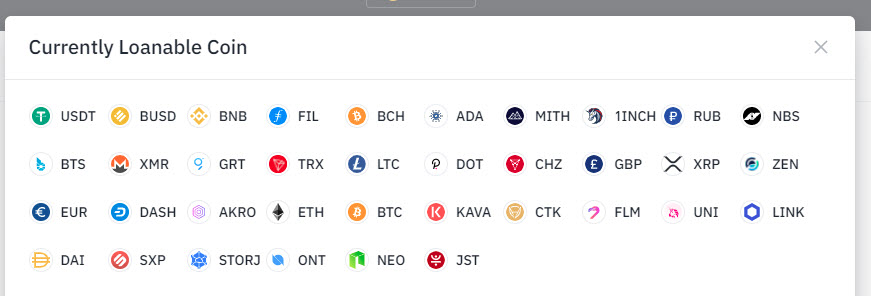

- Select the Coin you wish to borrow (you can borrow lots of different cryptos including stablecoins USDT and BUSD, see below full list of coins you can borrow).

- Enter the Amount you wish to borrow.

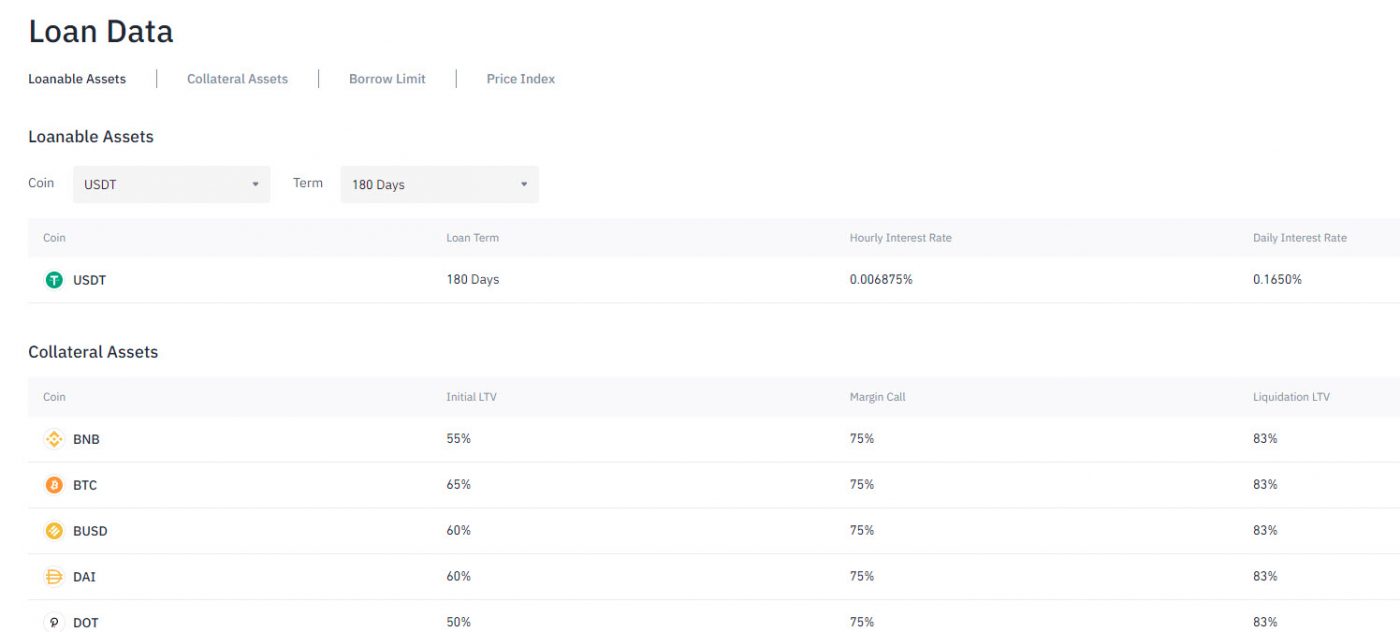

- Select how long you want to borrow it for (can be 7 days, 14 days, 30 days, 90 days or 180 days). The interest rates will change depending on the duration chosen.

- Once your ready, click Start Borrowing Now

- Read and agree to the Terms & Conditions

That’s it! You should now see +100 BUSD in your Spot Wallet account and also the BTC deducted from your balance to be held in the loan.

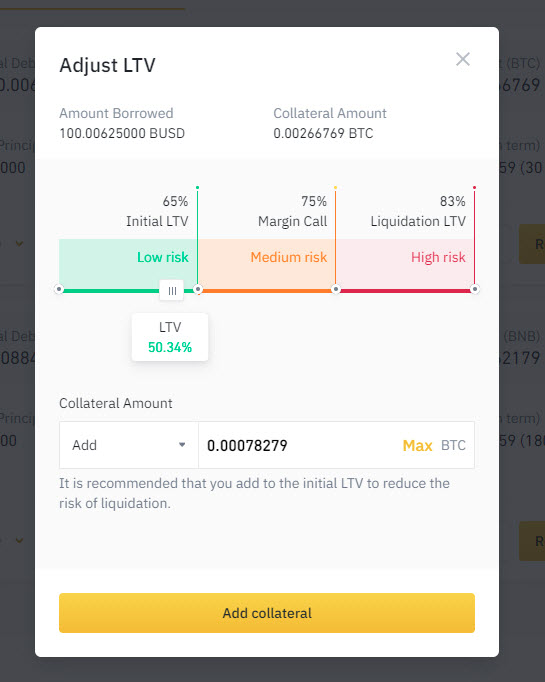

How To Adjust the LTV Risk Level?

The loan to value ratio (LTV) shows your risk level of the percentage your borrowed compared to the coin you lent. To have less risk you can lower this value to below 65% and add more BTC as collateral, which will reduce the likelihood of a margin call should the Bitcoin price drop suddenly.

How Much Can You Borrow?

You can check the Crypto Asset Loan Data to see the minimum/maximum lending amounts for each coin and the interest rates for the lending pair.

How Do You Pay the Interest?

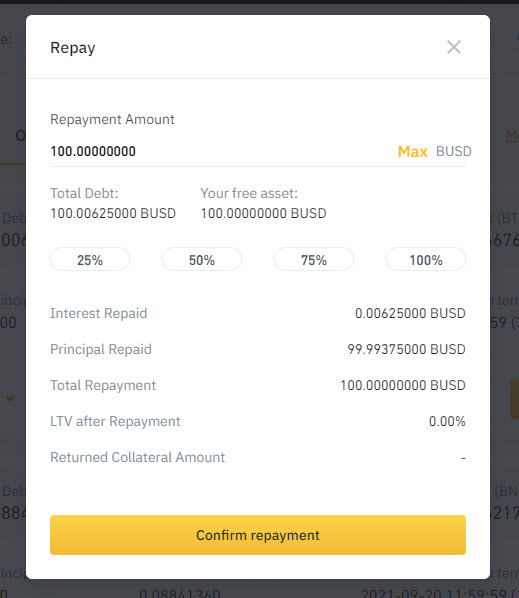

The total interest for the period is added to your Collateral Coin value when you apply for the loan, so apart from the potential margin call there is no additional payments. The fees get automatically gets deducted (paid as interest) hourly at the rate agreed on (when you applied for the loan).

How Do You Close The Loan?

You can repay (close) the loan at any time without extra fees by simply clicking the Repay button. Select the amount you wish to repay (say 100%) and confirm the payment. This is an instant and simple process.

How Does the Margin Call Work?

If the Collateral Coin drops in value compared to the Coin Borrowed, you may get a “margin call” which you will have to deposit more Collateral Coin to adjust the LTV back to a normal risk level (say below 65%)

What Cryptos can I borrow and lend?

You can currently borrow the following coins:

USDT, BUSD, BUSD, BNB, BNB, FIL, FIL, BCH, BCH, ADA, ADA, MITH, MITH, 1INCH, 1INCH, RUB, RUB, NBS, NBS, BTS, BTS, XMR, XMR, GRT, GRT, TRX, TRX, LTC, LTC, DOT, DOT, CHZ, CHZ, GBP, GBP, XRP, XRP, ZEN, ZEN, EUR, EUR, DASH, DASH, AKRO, AKRO, ETH, ETH, BTC, BTC, KAVA, KAVA, CTK, CTK, FLM, FLM, UNI, UNI, LINK, LINK, DAI, DAI, SXP, SXP, STORJ, STORJ, ONT, ONT, NEO, NEO, JST, JST

You can currently lend the following coins as collateral:

BNB, BTC, BUSD, DAI, DOT, EOS, ETH, EUR, LINK, LTC, USDC, USDT, XRP, XTZ

What Happens If I get Liquidated?

Liquidation can occur if the Collateral Coin’s total value is equal to the Borrowed Coin’s value. If this happens the loan is liquidated where the Collateral Coin is automatically sold to pay for the Borrowed Coin’s value and the loan is closed. There is no additional steps for you and you’ll be notified of the liquidation. You still keep the originally Borrowed Coin from the loan and don’t need to pay that back.

Can You Trade or Withdraw Borrowed Crypto?

Yes, you can trade on Binance using the loan borrowed crypto in both spot and margin trading. Yes, you can withdraw them as well.

What Are The Tax Implications?

Coming soon. We’ll update this section from Tax Accountant advice soon.