How to Buy Crypto ETFs in Australia

Spot crypto ETFs are a new and simple way to get Bitcoin or Ether exposure inside a traditional brokerage account.

The allure of these financial products is their straightforwardness – you buy them like any stock or ETF, and behind the scenes, the issuer holds the coins in institutional cold storage on your behalf. The fund, typically comprising 1:1 reserves, then tracks the price of the underlying asset.

The US has the most popular crypto ETFs, like BlackRock’s IBIT and VanEck’s HODL, while Australia offers options like 21Shares EBTC and EETH on Cboe/ASX.

This guide will walk you through the basics of spot crypto ETFs, how to buy them, and the top options in Australia (and in the US as well).

What are Spot Crypto ETFs?

On the surface, a spot crypto ETF is just a regulated asset that tracks the price of a crypto – like Bitcoin (BTC) or Ether (ETH) – and trades on a stock exchange. For example, BlackRock’s iShares Bitcoin Trust ETF trades on the NASDAQ under the ticker IBIT.

Now, how does it work? Well, you buy it in your brokerage account the same way you buy any stock or ETF. The fund’s price moves with the coin’s price. So, if Bitcoin goes up 10%, the ETF should be up about 10% minus fees (we’ll explain later).

The issuer, like BlackRock or VanEck, stores the coins with a professional custodian, mostly in offline (‘cold’) storage like Coinbase Custody.

How to Buy a Spot Crypto ETF?

Buying a spot crypto ETF works like buying any other stock. You use a broker to place buy and sell orders on your behalf on exchanges like the ASX or Cboe Australia.

A quick rundown in three steps:

- Open a brokerage account and fund it

- Look up the ETF’s ticker, and place an order during market hours.

- You could either go with a market order, which fills immediately at the best available price, or a limit order lets you set the maximum you’ll pay, which is useful when prices move fast.

In Australia, for example, you can buy Global X 21Shares Bitcoin (EBTC) and Ethereum (EETH) through standard brokers on Cboe and the ASX. Ideally, check with your broker for the exact ticker and trading hours before you place the trade.

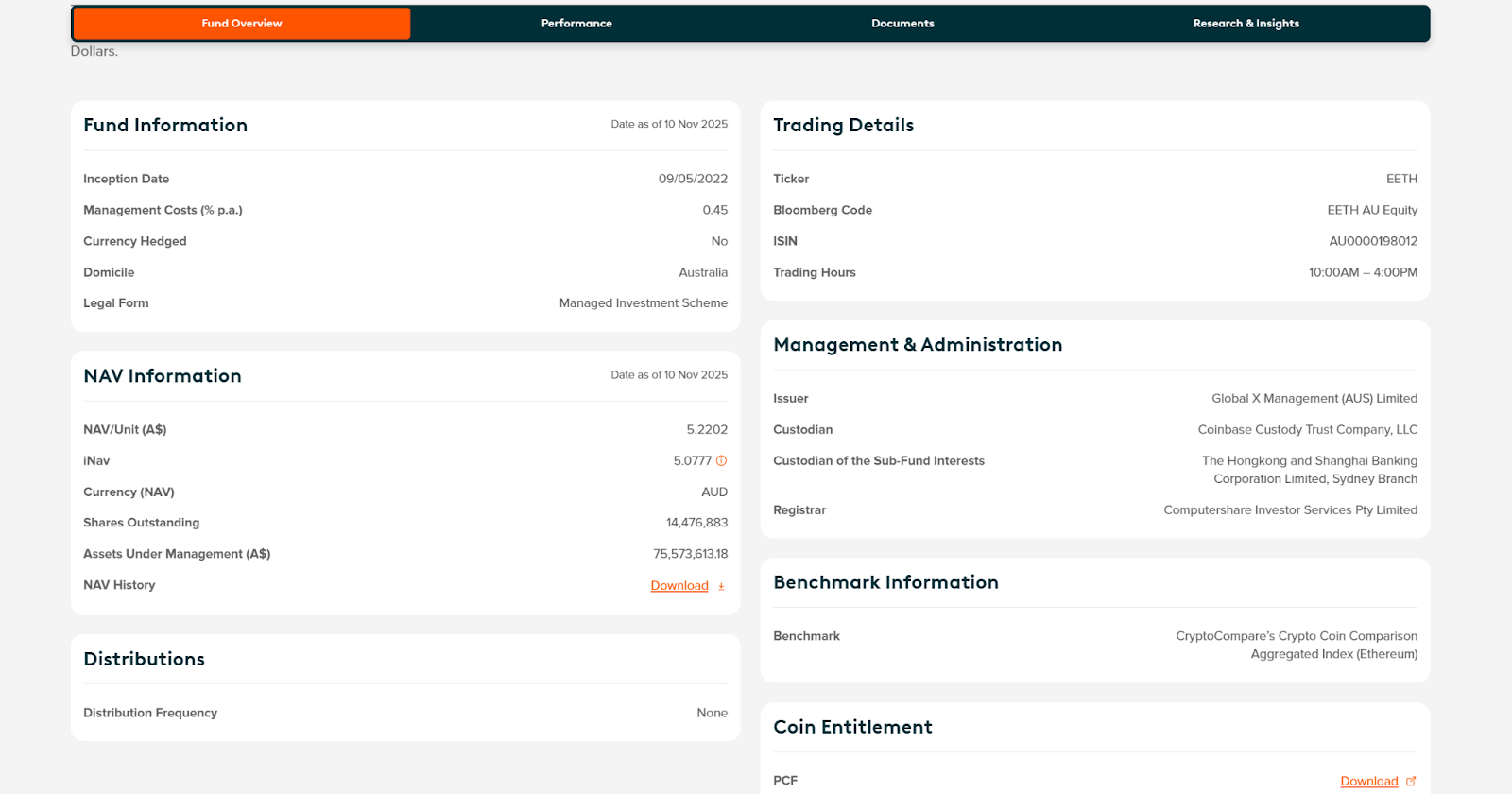

You can always check the issuer’s official ETF page to know more information about the product, like management fees, AUM, legal form, NAV, shares outstanding, performance, etc. EETH’s page is quite comprehensive, for example:

What are the advantages and disadvantages of a crypto ETF?

The main benefit is simplicity, because you don’t need crypto exchange accounts, or wallets to gain exposure to the crypto market. You don’t even need private keys.

It also fits in retirement accounts where allowed. For instance, Australians can open a dedicated SMSF account for crypto ETF trading, and the funds should come from the personal SMSF bank account.

Costs are straightforward as most ETFs charge an annual management fee – however exchanges will likely also charge trading spreads and brokerage fees.

Like everything, there are a few disadvantages to consider:

- You own the shares, not the underlying coins, so you cannot use them for payments, staking, or any DeFi activity. However, some ETFs have explored in-kind redemptions and staking on your behalf. An example of this is the Solana staking ETF.

- ETFs trade only during market hours, while crypto trades 24/7, so opening gaps can happen after big overnight moves.

- General risks apply, crypto is volatile, small premiums or discounts to net asset value (NAV) can appear in stress, and you rely on the fund and its custodian.

Let’s explain a bit better that last point: crypto trades 24/7 but ETFs trade only during market hours, and each fund calculates NAV at the close. That timing gap can make the ETF trade a bit above or below its fair value.

In big, liquid funds, these gaps are usually tiny, often under 0.5% and around 0.1% when in calm periods. But in fast selloffs, especially with thin ETFs, they can widen to up to 5%.

What are the most popular crypto ETFs?

Crypto ETFs in Australia

Below are some of the best Crypto ETFs in Australia, broken down by management fee, underlying issuer, popularity, performance, and other important metrics.

Betashares Bitcoin ETF: QBTC

QBTC was launched by Betashares, and obtains its Bitcoin exposure through an indirect structure, investing in the NYSE-listed Bitwise Bitcoin ETF, which is operated by Bitwise, the largest crypto index fund manager in the US.

The fund has a low management fee of 0.45% per annum, making it one of the most cost-effective Bitcoin ETFs available.

VanEck Bitcoin ETF: VBTC

VBTC, the first Bitcoin ETF to list on the ASX, employs a feeder fund structure, investing directly in the US-listed VanEck Bitcoin Trust (HODL), which is regulated by the SEC and listed on the Cboe BZX Exchange.

Operating as a feeder fund means VBTC provides indirect exposure to Bitcoin, with investments subject to both Bitcoin price fluctuations and USD/AUD exchange rate movements. The fund carries a management fee of 0.45%.

21Shares Bitcoin ETF: EBTC

EBTC was launched by 21Shares and tracks the performance of Bitcoin in AUD. The fund distinguishes itself through 100% physical Bitcoin backing, with all BTC held in cold storage by Coinbase Custody.

It charges a management fee of 0.45% and trades on Cboe Australia. It also employs a sharding mechanism, which breaks keys into smaller chunks distributed across multiple global servers.

21Shares Ethereum ETF: EETH

EETH is Australia’s first spot Ethereum ETF, launched May 9, 2022, alongside EBTC on the Cboe Australia exchange. It provides direct exposure to physical ETH held in cold storage by Coinbase, and uses the same security framework as EBTC.

EETH’s management fee is 0.45%, placing it among the lowest-cost Ethereum ETFs available.

Crypto ETFs in the United States

The Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs in January and Ethereum ETFs in May of 2024, becoming two of the most successful investment vehicles in the United States.

For instance, BlackRock’s IBIT accumulated over US$50 billion (AU$76 billion) in just eleven months, the fastest-growing ETF ever. Overall, spot Bitcoin ETFs have exceeded US$100 billion (AU$153 billion) in total assets under management (as of November 2025).

From Australia, you’d basically buy US crypto ETFs through an international brokerage app. Some popular options include Webull, moomoo, and Interactive Brokers.

There are more than 10 options for both Bitcoin and Ether ETFs, but we’ll narrow it down to the most popular options.

BlackRock’s iShares Bitcoin Trust: IBIT

IBIT is BlackRock’s flagship crypto ETF and the clear market leader with around US$80 billion (AU$120 billion) in AUM. It holds Bitcoin, trades on Nasdaq, and closely mirrors the performance of the underlying asset.

It charges 0.20% a year. BlackRock will also launch IBIT on the ASX in mid-November of 2025, charging a management fee of 0.39%.

Fidelity Wise Origin Bitcoin Fund: FBTC

Launched by Fidelity, FBTC is the second largest in size at about US$20 billion (AU$ 30.6 billion). It allows investors to gain exposure to Bitcoin’s performance, and keeps all of its funds safe by using Fidelity Digital Assets for custody.

Expense ratio 0.25%, just a tad higher than BlackRock’s IBIT but still competitive enough for investors.

Grayscale Bitcoin Trust: GBTC

Probably the oldest Bitcoin fund (launched in 2013), GBTC turned into an ETF in January 2024 in the beginning of the crypto ETF race. It holds Bitcoin at Coinbase Custody, but do keep in mind the fees are quite high at 1.50%, a holdover from pre-2024 days (it’s a sort of legacy fee for being the first to do it).

VanEck Bitcoin ETF: HODL

Trading on the Nasdaq, VanEck’s HODL is an interesting one; it launched with a unique fee dynamic, in which it waives fees entirely on the first US$2.5 billion (AU$3.8 billion) in assets, until January 10 of 2026 (or if the fund surpasses that threshold beforehand).

This aggressive fee waiver strategy is VanEck’s push to gain market share in the competitive Bitcoin ETF space.

iShares Ethereum Trust: ETHA

ETHA is BlackRock’s ETH fund that gives direct price exposure to Ether and tracks the CME CF Ether-Dollar Reference Rate NY Variant, which is a regulated benchmark index price for ETH in US dollars.

It trades on Nasdaq and aims for clean, passive tracking, so results should broadly follow ETH after fees.

Grayscale Ethereum Trust: ETHE

ETHE’s is Grayscale’s ETH vehicle, which followed a similar path to GBTC, moving from an older structure to an ETF in 2024. It holds ETH with Coinbase Custody and manages roughly US$3.45 billion (AU$ 5.28 billion) as of November 2025. And yes, the trade-off is the massive management cost: a 2.50% annual fee.

Closing Thoughts

Spot crypto ETFs give investors direct price exposure to Bitcoin or Ethereum inside familiar, regulated brokerage rails.

Investors like spot crypto ETFs because it provides exposure with stock-market convenience, so simple orders, one statement, and, where allowed, use in retirement accounts, which is quite handy for Aussies with SMSFs accounts.

All things considered, they pretty much behave like normal ETFs, at least in their mechanics, yet no one, not even institutions can sometimes escape the inherent volatility of the crypto market. Even so, they have become one of the best ways for crypto to go mainstream and have a place in the world of traditional finance.