Bull Market vs Bear Market: What’s the Difference?

What is a bull market and bear market? Whether talking about cryptocurrencies, equity, or real estate, all markets have periods where we can categorise them as either “bearish” or “bullish”. These terms refer to market conditions where a joint situation occurs over a medium or long-term period, usually lasting 1 year or more.

What is a Bull Market?

A bull market is where most assets surge in price gradually. Supply is big and investors are buying more as demand rises. We can say that the market is bullish when most assets of a specific market are in an uptrend.

When investors say they’re bullish on a market, they expect prices to rise for a long period. However, no one knows exactly how much a bull run can last, but they are usually longer than bearish markets and are less volatile.

How to Identify a Bull Market Trend

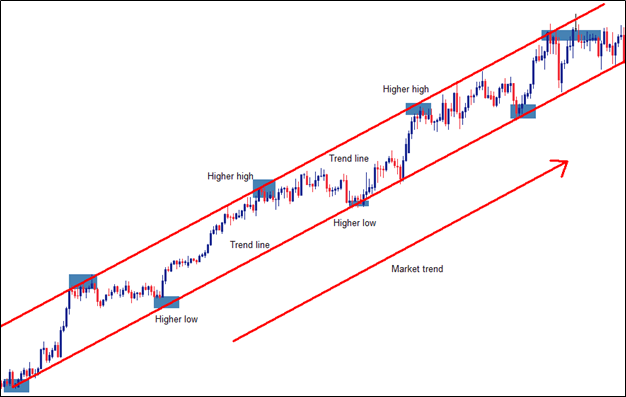

Trends are never straightforward, they have periods of fluctuation and price drops categorised as higher highs and higher lows.

It’s reasonable for a trader to follow the trend and not go against it. This is why it’s important to pay attention to price declines or consolidations when they appear. They don’t usually break the current trend (unless a big event occurs that completely flips it) but they can give you a window of opportunity to enter the market.

What Factors Can Create a Bull Market?

Several forces drive demand up or down. Take for example how the COVID-19 pandemic boosted the crypto market and practically shut down the global economy. What did happen during that time of crisis? Well, to name a few things:

- Small, mid-size businesses started closing and unemployment rates skyrocketed.

- Governments started sending relief packs embedded as monthly checks and injected trillions of dollars trying to help their citizens in the time of crisis.

- Global central banks started printing trillions of dollars to help stabilise their respective countries.

Remote jobs became a priority for most companies globally, and people were forgetting about physical cash and paying for things using digital money on the Internet, like e-commerce websites. This reinforced and highlighted the benefits of cryptocurrencies, not only in times of financial crisis but in general.

How Did Institutional Capital Boosted the Crypto Market?

Investors knew that as central banks printed more and more money, so they wanted to hedge against fiat hyperinflation, and cryptocurrencies became an attractive alternative for them. Thus institutional capital flocked to the crypto market as more clients demanded alternative assets that could make up for a better store of value.

Investment banks like JP Morgan, Goldman Sachs, and Morgan Stanley; Payment Giants like Visa, Mastercard and PayPal; Hedge funds and institutional investors —the list goes on. They all at first condemned cryptocurrencies and their usefulness in real-time situations, and now most of these companies support them.

Investment banks started offering Bitcoin trading services among other crypto-related services to their clients. JP Morgan even offered job positions for Ethereum blockchain developers. PayPal allowed crypto custody and crypto-payments just like Visa and Mastercard.

News, adoption, and the overall benefits of crypto during these periods gave the crypto market and the decentralised finances (DeFi) ecosystem, which is now over US$60 million in total value locked, a dramatic boost.

Crypto Adoption is Accelerating

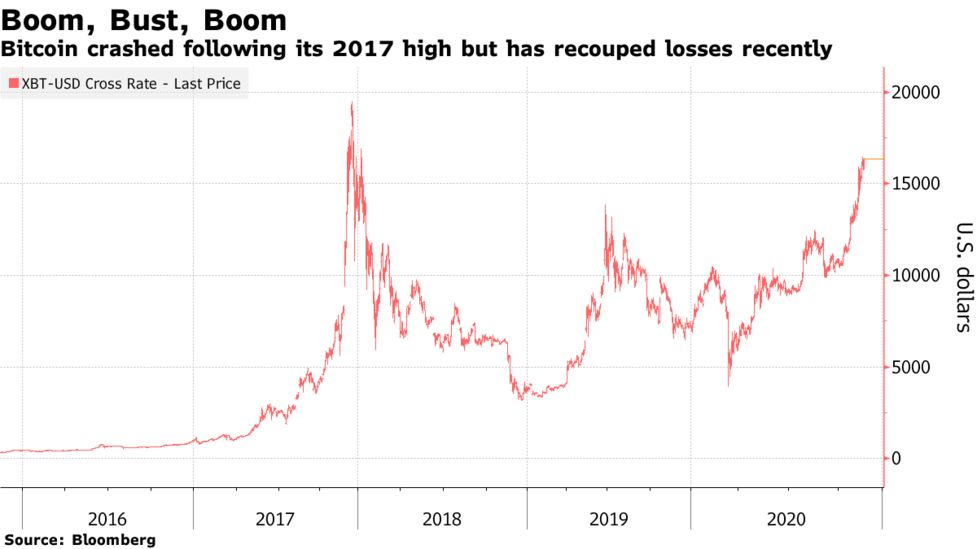

In January 2020, BTC was priced at over $7,000. By December, it was breaking one of the toughest psychological barriers: $20k, reaching over $24,000 that month. This is an increase of 224%. When institutional capital came into play and cryptocurrencies were all over the news, Bitcoin surpassed astronomical price records of over $40,000 in January 2021.

This doesn’t mean the market didn’t experience fluctuations during its bull run. The most notorious price corrections happened on February 21, when it dropped more than 20% between February 21 and 23, shortly after reaching a price record of US$58,322.

However, crypto adoption only accelerated with time, and now most institutional investors plan to own crypto by 2026.

What is a Bear Market?

Within a bear market, most assets are in a downward trend. Demand is low and most investors are selling their positions, further pushing the downtrend. However, most investors won’t call it a real bear market unless it loses 20% from recent highs. In essence:

- Bearish periods apply to every market

- Most assets move in a downtrend

- Negative investors’ sentiment takes over

We all know The COVID-19 outburst shut down the entire economy and caused one of the toughest stock market crash in history. However, it accelerated Bitcoin’s rise to the eye of investors and amplified the narrative of Bitcoin as a safe store of value against the decaying purchasing power of the U.S. Dollar.

Large price drops will trigger weak hands. This is usually called “panic selling.” There’s an interesting feature within the crypto market when this happens: most crypto holders (called HODLers) would look at this as an opportunity to buy as many coins as they can and profit from the next bull run. Interest is low and the usual buyers in these periods are miners and Bitcoin maximalists who want to stack as many BTC as they can.

And why do crypto traders do this? Because the crypto market has a finite supply in contrast to the infinite supply of fiat currency.

On the other hand, bullish crypto markets are dynamic with supply and demand in a perpetual state of flux as new participants and older HODLers compete for block-space, testing each other’s resolve to HODL in the face of parabolic price growth.

Let’s take Bitcoin as an example. While Bitcoin has surged in value over 9000% since 2015 it doesn’t mean the market hasn’t experienced bearish periods. In December 2017, it had one of the largest bearish runs that extended to mid-2019.

Why Timeframes are Important

Using time frames properly is key to understanding the current state of the market so you trade it accordingly. Time frames can be classified as primary (longer periods), intermediate, and short-term, and each one will give you a different perspective of the market.

A rule of thumb is to always trade the primary time frame as market signals are more reliable. On shorter time frames, traders might find cluttered charts with exaggerated long spreads. However, this time frame works well for short-positions, so everything depends on the trader and the way he wants to trade.

Ideally, a trader bases his first technical analysis by studying the longer time frame to define in what direction the market is going. Bull markets usually last months or years, so to do a proper market analysis, setting a higher timeframe will help you have a better notion of what’s happening.

How Long Do Bear and Bull Markets Last?

Nobody knows how long these periods last. Usually, bull markets have greater and stronger rallies —they could last one year or exceed 10 years. On the other hand, bear markets have a shorter duration, but they come with more abrupt movements and volatility.

In the case of the stock market, assets don’t usually fluctuate by high points of percentage. Fiat currencies, for instance, are not stable —the degree to which they fluctuate is small and that’s why people consider them stable.

The Volatility of the Crypto Market

In contrast, the crypto market is volatile. Crypto assets can fluctuate by hundreds or thousands of points per day, and as crypto becomes mainstream and financial institutions start digging into crypto and blockchain technology, the price has been subject to harsh market corrections and explosive price surges.

News, institutional adoption, major events (like the China FUD), or even a comment from a wealthy influencer can cause powerful price surges or corrections that either boosts the market or stagger it, shrouding investors’ sentiment with pessimism or optimism.

Closing Thoughts

bull and bear markets can always be traded. Identifying what are the market conditions will help you to better manage your capital and invest more smartly.

During a bull run, most traders would follow the trend by applying their trading strategy. Traders entering the market set lower time frames after identifying the primary trend to define their next position.

During bear markets, traders are wary and try to protect themselves from larger price drops. It’s advisable to stay in cash during these periods, wait and study the market to catch an opportunity to trade it.