Grayscale Confirms its Intentions to Turn GBTC into a Bitcoin ETF

Grayscale’s CEO, Barry Silbert, has confirmed the investment firm is “100% committed” to turn GBTC (Grayscale Bitcoin Trust) into a Bitcoin Exchanged-traded Fund.

As per their post, the investment giant outlined the possibility of a BTC ETF in the United States. Other investment firms like Goldman Sachs have filed with the Securities and Exchange Commission (SEC) to launch the long-awaited crypto-fund, but Grayscale remains wary about submitting a file to the SEC.

The firm does not consider that the current regulation weather in the US is suitable for such a fund.

Today, we remain committed to converting GBTC into an ETF although the timing will be driven by the regulatory environment. When GBTC converts to an ETF, shareholders of publicly-traded GBTC shares will not need to take action and the management fee will be reduced accordingly.

GrayscaleAdvertisement

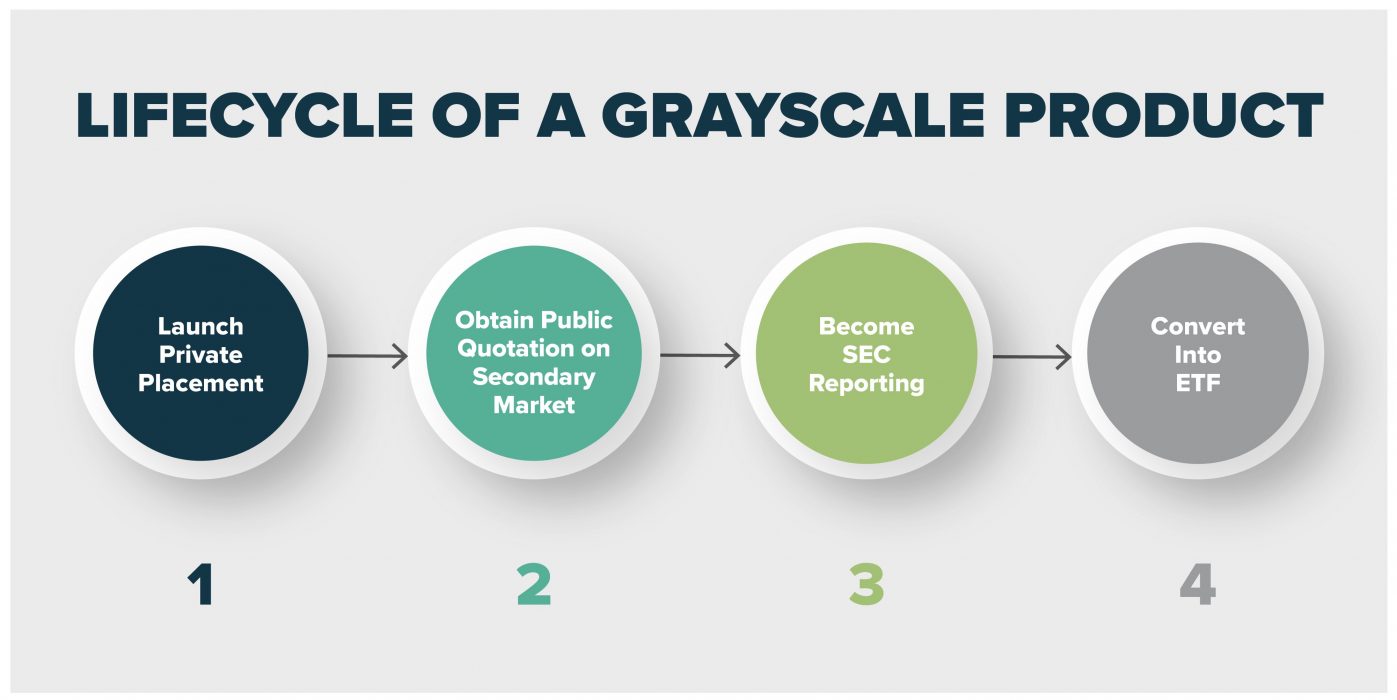

GBTC is a SEC-reporting Bitcoin fund launched in 2013. Each Grayscale product has four stages, in which the last one aims to convert the product into an ETF.

The Crypto Market Tops $2 Trillion

Grayscale’s announcement came at the same time the global crypto market hit $2 trillion, according to CoinGecko. The institutional adoption of cryptocurrencies has increased the demand dramatically, and the crypto community seems to be now waiting for SEC to finally approve a Bitcoin ETF. If approved, a Bitcoin ETF coupled with the public listing of Coinbase could give the crypto market a tremendous boost.