Crypto Market Dips After Surge, $750 Million Liquidated

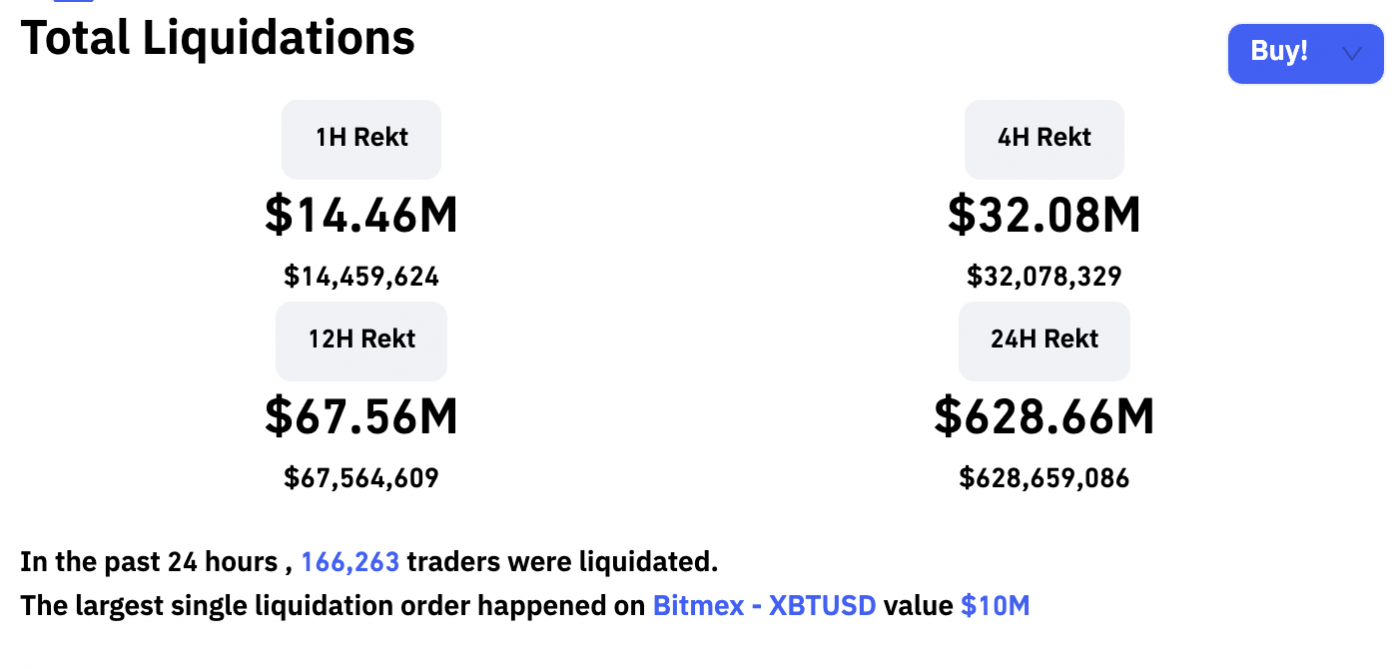

After a particularly profitable week in crypto, with bitcoin reaching new all-time highs, the market saw a sudden drop and more than US$750 million was liquidated, according to data from Coinglass.

BTC Takes a Nosedive

In the past 24 hours, after the crypto market saw some immense growth and bitcoin (BTC) reached a new all-time high of over US$69,000, a whopping 166,292 traders were liquidated to the value of over US$750 million when the price of BTC dipped below US$63,000.

The largest single liquidation order happened on Bitmex XBTUSD to the value of US$10 million. At the time of writing, the price of bitcoin had rallied to US$65,138, according to CoinGecko.

According to data from Coinglass (formerly Bybt), 81 percent of the liquidations observed came from long positions, with the majority of them happening on Binance.

Quantitative analyst PlanB, which has gained significant popularity for its eerie accuracy in predicting monthly closing prices for BTC, took to Twitter to post a funny meme about the liquidated positions:

Again, This Is Just a ‘Bit’ Too Soon

Liquidations such as the one we have just observed are becoming a far-too-common phenomenon. In September, for example, the crypto market saw some serious positions liquidated. Early in the month, the market recorded liquidations worth over US$3.7 billion due to a major downturn. Later, another major drop in the market saw over US$2.5 billion long positions liquidated in just two days.