Crypto.com Finally Admits Close to $34 Million Lost in Hack

Earlier this week, Crypto.com suspended withdrawals after some users reported suspicious activities on their accounts. Initial losses were estimated at US$15 million but later this ballooned to US$34 million, a figure that has since been confirmed by the world’s fourth-largest exchange.

A Rough Week for Crypto.com

On establishing that some 400 users had experienced unusual activity on their accounts, the company put a hold on withdrawals and reassured users that their funds were safe.

Early reports suggested that US$15 million had been stolen, as reported by blockchain security group PeckShield.

The stolen funds were subsequently laundered through popular coin mixer Tornado. However, one eagle-eyed on-chain analyst claimed that the losses were closer to US$34 million.

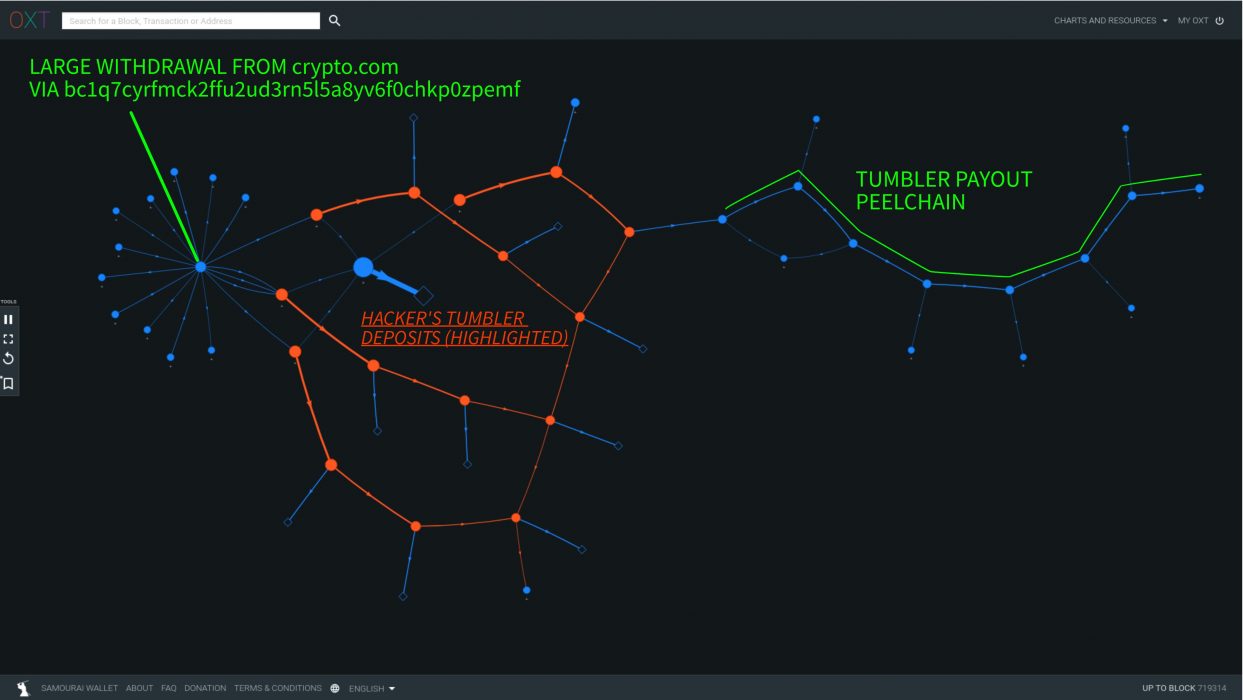

The on-chain analyst was initially alerted by an “abnormally large withdrawal” from Crypto.com that was then mixed through a well-known Bitcoin tumbler, as illustrated below:

Crypto.com Finally Confirms Losses

In a statement on its website, Crypto.com confirmed that the hack had impacted 483 users and that unauthorised withdrawals totalled 4,836.26 ETH, 443.93 BTC and approximately US$66,200 in other cryptocurrencies.

The company added:

No customers experienced a loss of funds. In the majority of cases we prevented the unauthorised withdrawal, and in all other cases customers were fully reimbursed.

Crypto.com statement on the hack

The company ascribed the hack to a problem with two-factor authentication (2FA) and said that going forward, it would put in place several mechanisms to create additional layers of security:

Based on replies to the Tweet above, it remains to be seen whether the matter is well and truly over, or if there is still more to come.