Concerns Of Bitcoin Illiquidity as Institutions Rack up Bitcoin With only 20% of Available Supply

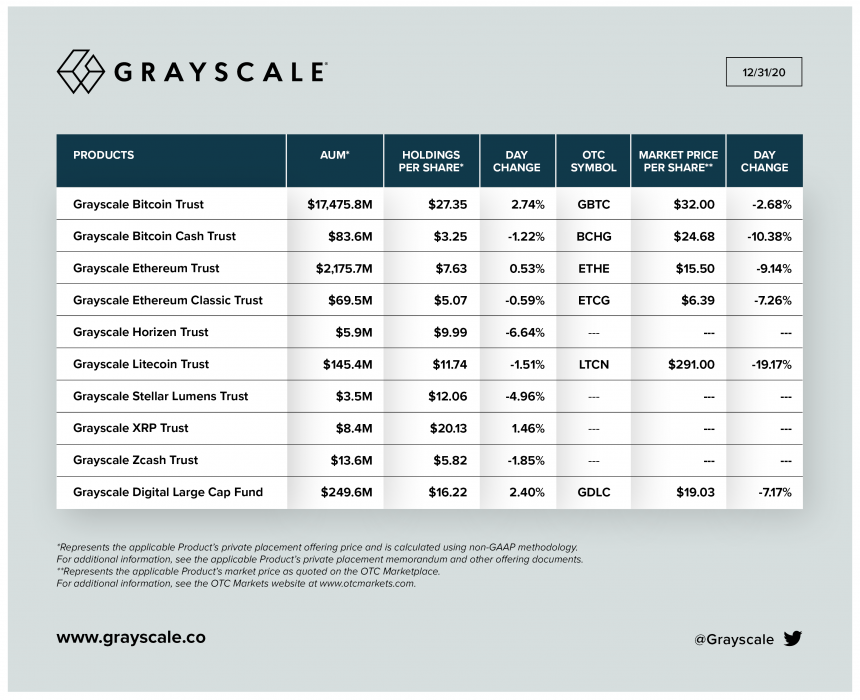

Recently, Grayscale released its total Assets Under Management (AUD), with a total of $20B worth of Bitcoin, surpassing the total amount of BTC mined throughout 2020.

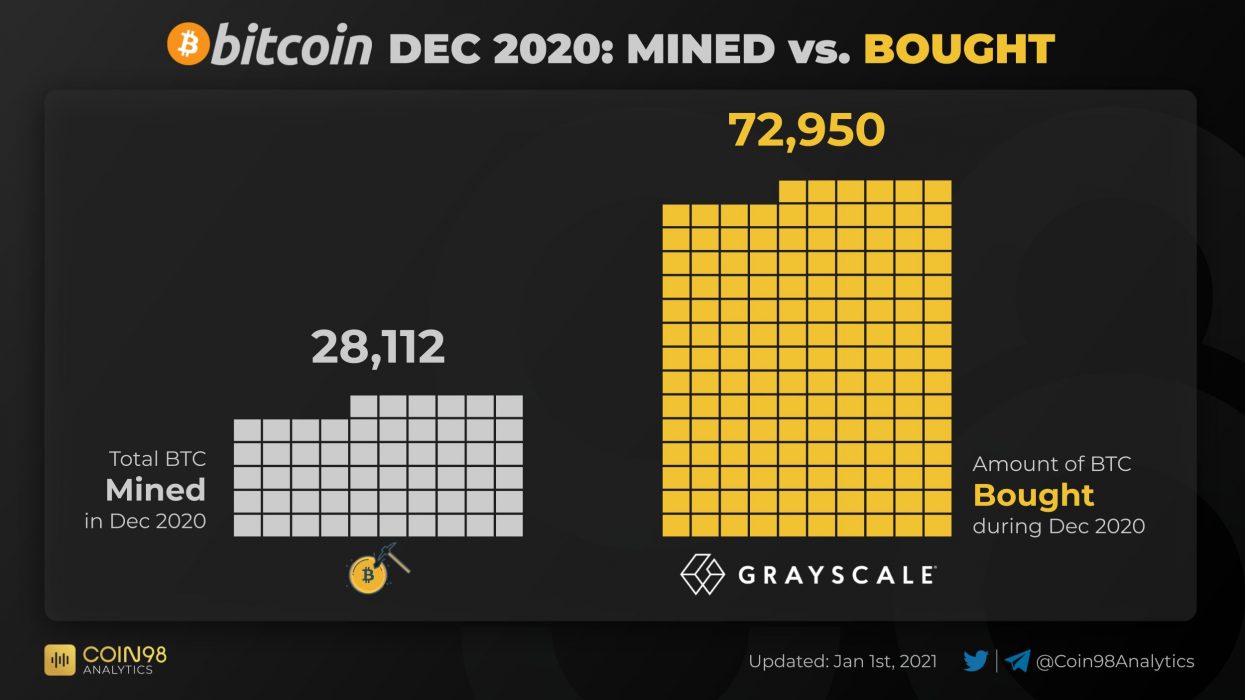

With more details, Grayscale amassed a total of 72,950 BTC, almost 3X mined last year, according to Coin98 Analytics:

The recent data heated the topic in the crypto community on how financial institutions are squeezing the Bitcoin supply. Credit card companies like PayPal and Visa embraced cryptocurrencies noticing the increasing general demand for better stores of value. But BTC has a limited supply, a key aspect of this scenario.

Not surprisingly, when institutions decided to hoard Bitcoin, the bull run escalated, and BTC and crypto were achieving a broader space on social networks. However, this recent massive accumulation of BTC has raised concerns about it.

How Much BTC Is Left For Retail Traders Then?

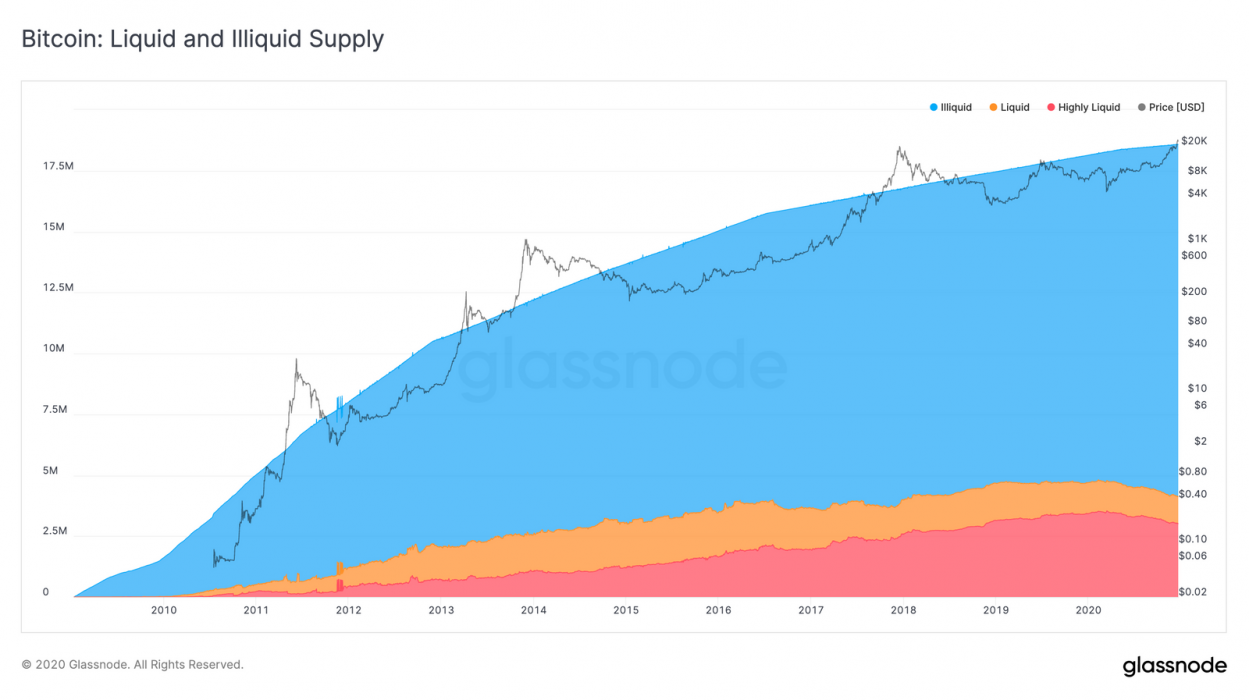

According to data from Glassnode, Bitcoin is on a stage where the illiquid supply is greater than the liquid supply, which is what is driving the current bull run on BTC. Out of the total 70 % Bitcoin supply, only 20% is available for trading on exchanges. Likewise, another reason behind the current decrease is the shortage of ASIC miners.

Our analysis shows that currently 78% of the circulating Bitcoin supply (14.5 million BTC) can be classified as being illiquid. A trend that has been increasing over the course of 2020 and paints a potential bullish picture for Bitcoin in the upcoming months, as less BTC are available in the network to be bought.

Stated the company

The massive adoption of crypto by institutions sets the bullish scenario, as miners are producing and selling less – plus the lost BTCs and the holders make the BTC supply small, driving the price up.

Another topic discussed in crypto forums is —ironically— a possible fully centralized scenario for Bitcoin, as institutions hoard massive amounts of BTC, drying the supply and changing the original decentralized concept.