Chainalysis Report Shows Scam Revenue Rose 81% in 2021

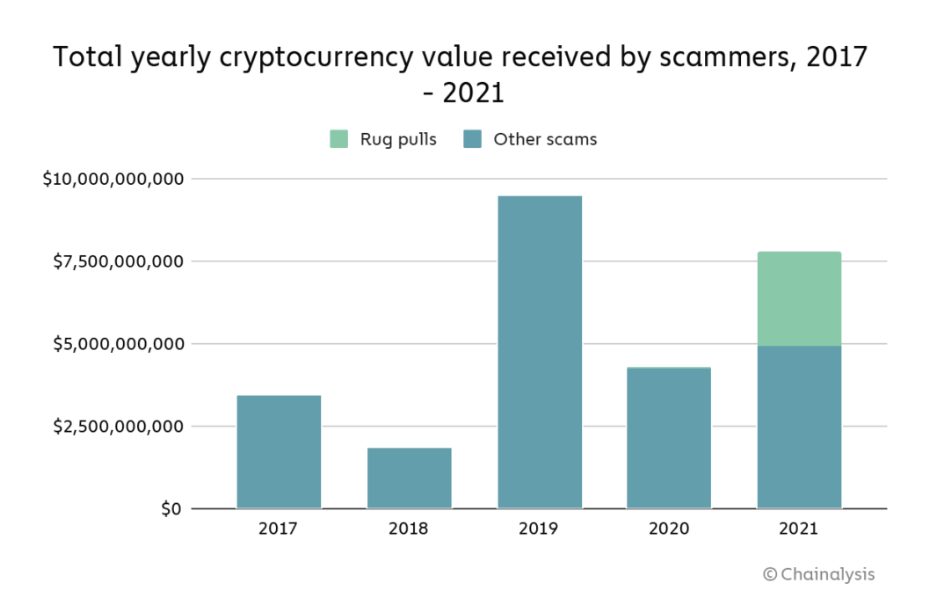

Cryptocurrency scams, particularly rugpulls – when a team behind a project cuts and runs with investors’ funds – have become the main issue for trusting the crypto space, especially for newcomers. Now a recent report from Chainalysis has revealed that crypto scam revenues have risen by 81 percent in 2021.

Crypto Scams Skyrocket in 2021

In 2020, the number of scams dropped considerably compared to 2019, but it appears that new forms of deceiving investors, such as rugpulls, are dramatically increasing, according to Chainalysis’ 2022 Crypto Crime Report.

Rugpulls accounted for 37 percent of 2021’s crypto scam revenues. Another factor that propelled scammers to deceive naive investors was the rise of Finiko, a massive Ponzi scheme targeting Russian-speaking countries. Finiko was shut down by authorities and its founders were arrested, but not before investors lost US$1.5 billion worth of crypto.

However, things aren’t as bad as they look, as Chainalysis has found a way to protect users from scams. Cryptocurrency platform Luno partnered with Chainalysis to help the blockchain to identify scammers’ addresses, thus halting users’ transfers before they were processed.

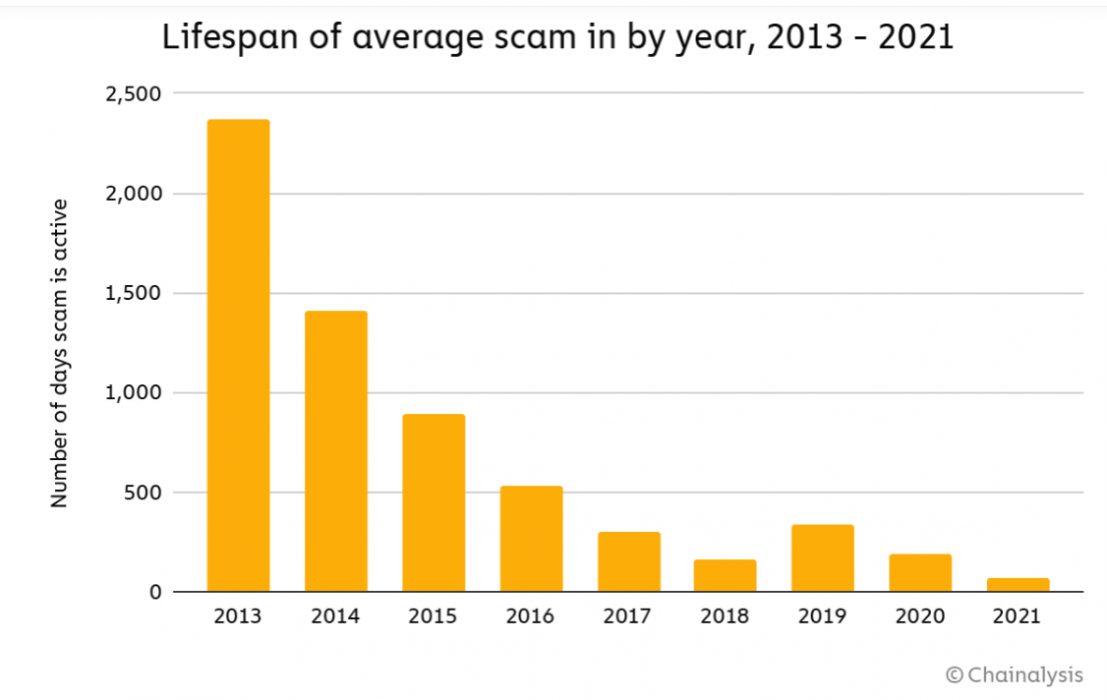

The other good news is that the average scam lifespan has been decreasing compared to previous years, starting from 2013.

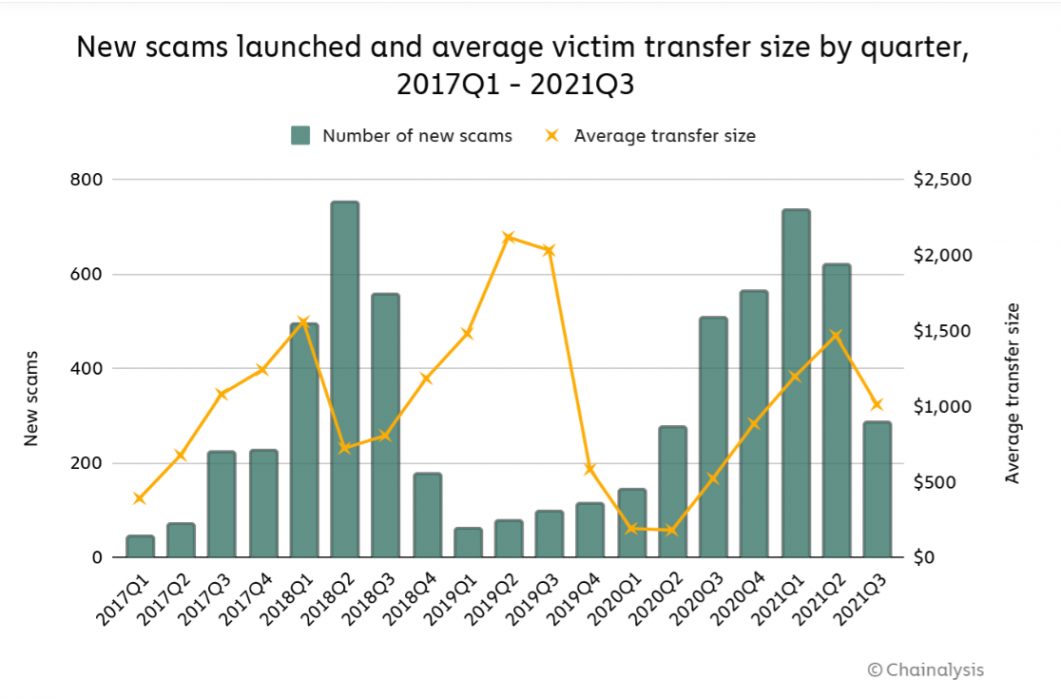

The Market is Maturing

Another glimmer from Chainalysis’ report is that the crypto market appears to be maturing, as the relationship between crypto prices and scam activity appears to have ended.

Chainalysis Makes Waves in the DeFi Ecosystem

Chainalysis is one of the most trusted blockchain data platforms in the space. Besides crypto crime reports, the firm also provides an annual Geography of Cryptocurrency report, outlining the fastest-growing crypto adoption rates in countries worldwide.

Last month the firm partnered with the Commonwealth Bank of Australia, opening an office in Canberra to strengthen its presence in the Pacific region.