Chaos to Clearing: Solving Crypto’s Market Structure Hurdle with Continuous Auctions

After the dismissal of a potential Central Bank Digital Currency (CBDC), blockchain-powered stablecoins began carrying the mission of entrenching the US dollar’s reserve currency status.

This has been a theme of Trump’s from early on in his second term. The latest such signal comes from the Commodity Futures Trading Commission (CFTC), with Acting Chairman Caroline Pham having noted in December that “outdated guidance” related to digital assets will be scrapped.

Eliminating outdated and overly complex guidance that penalizes the crypto industry and stifles innovation is exactly what the Administration has set out to do this year.

While the regulatory path for digital assets continues to be cleared, the technological path still faces a major hurdle – market structure. If the USD is to begin to rely more on decentralized rails, those rails cannot be plagued by MEV (Maximal Extractable Value), front running, and volatile, unfair token price launches.

One of the solutions to this problem comes from the crypto sector itself in the form of Continuous Clearing Auction (CCA). But first, let’s examine how Token Generation Events (TGEs) are typically conducted.

The Problem with TGEs

As the launch of a new cryptocurrency for public distribution, Token Generation Event (TGE) often determines if the project will have staying power. All three phases – generation, distribution, sale – of a new token must be executed competently to gain Web3 viability, but even competence can be suppressed by fundamental issues.

The first problem that arises when a new tokenised asset launches, including tokenised securities, comes from chaotic price surges that tend to scare off serious capital. These early bursts of volatility often resemble traditional market behavior such as a breakaway gap, where prices jump sharply before stabilising as liquidity builds.

According to Antonio Sco, who worked with over 30 pre-TGE projects over the last two years, the overwhelming majority of TGEs fail because of three main reasons:

- Market Maker (MM) Selection: MMs tend to be plagued by information asymmetry, considering that MMs only showcase success stories. More importantly, MMs could have incentives that conflict with the project’s long-term health (i.e., short-term profit), potentially causing severe token price crashes.

- Flawed Tokenonomics: Just as the movie industry tends to copy movie ideas, for those copied movies to then flop, a similar dynamic is present when a tokenomics model is copied from successful projects. That’s because investor goals and market appetites are constantly evolving. Project founders also have to go against the immediate return demand from seed investors, airdrop hunters and social media naysayers to skew tokenomics in their short-term favor.

- Exchange Listing Risks: Prior to TGE, the process is fraught with predatory listing terms and high fees that often result in selling pressure with no corresponding buying interest.

According to CoinGecko’s April 2025 report, 52.7% of all launched cryptocurrencies failed, most of them in the last two years. According to Web3 venture studio Syndika, TGEs also suffer from poor market timing. If the project is launched in a bear market, or adjacent to a rival project, its liquidity can stall and undergo rapid devaluation despite strong fundamentals.

And given the sheer number of token launches, the failure of a TGE to be flawless has the critical effect of reducing a project’s traction among serious investors, even if the underlying technology is sound.

All of these issues clearly demonstrate the need for a more robust, fair, and transparent mechanism for launching and distributing new digital assets if they are to form a reliable blockchain-powered infrastructure that adopts stablecoins.

In this light, Continuous Clearing Auction (CCA) may be the essential innovation that upgrades the crypto market structure.

How Does CCA Work?

In November, the decentralized exchange (DEX) Uniswap unveiled its permissionless protocol Continuous Clearing Auctions (CCA). Uniswap is the most embedded DEX, across 38 chains, and has churned $72 billion in volume over the last 30 days, according to DeFiLlama.

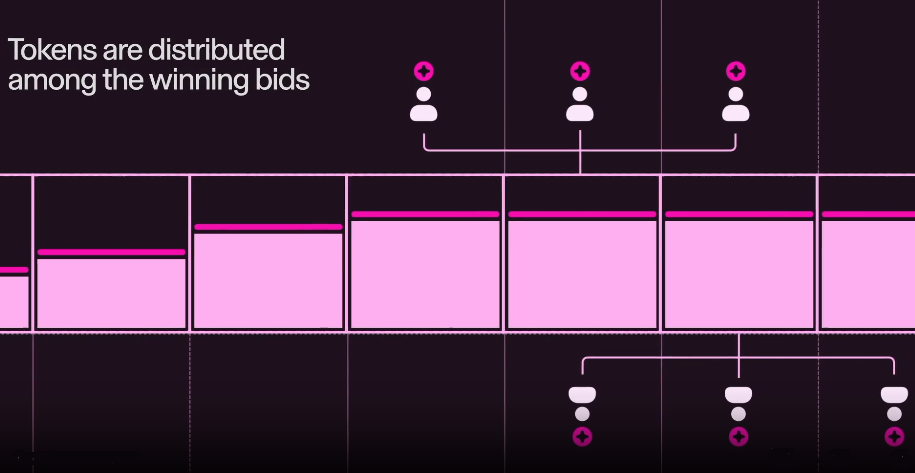

In essence, CCA systems treat your single bid (purchase order) as a stream of smaller transactions that happen over time. When participating, investors enter a max price and a total spend. If, throughout the ‘auction’ the floor price of the asset exceeds the investor’s preset max price, the bid automatically stops, preventing overpayment.

This mechanism helps address the aforementioned issues in the following manner:

- Through automated, algorithmic price discovery, CCA alleviates MM risk as it removes the need for a single, centralized market maker. Instead, the price is determined transparently through the collective actions of all buyers and sellers. Because these bids are spread across future blocks of data on the blockchain, it becomes much harder for any malicious third party to cause a sudden price crash or manipulate the market for their own gain.

- Instead of relying on the potential misadvice from consultants to form flawed tokenomics, CCA gives TGEs constant price adjustment, as the token price is continuously discovered and cleared (within each block) by the market. As the system clears and finalises the price for every single block, it establishes a reliable price floor for the blocks that follow. This creates a more robust distribution mechanism where the token’s value is a true, constant reflection of actual supply and demand.

- Lastly, when it comes to exchange listing risk, CCA is deployed on a DEX like Uniswap. This completely bypasses the centralized (CEX) listing process, eliminating the problems of difficult communication, last-minute changes, predatory listing terms, high fees and susceptibility to scams.

At the end of the line, upon the closure of CCA, Uniswap v4 liquidity pool is automatically created at CCA’s discovered price. Optionally, project leaders could generate new ERC-20 tokens with cross-chain capability and metadata.

TGEs are notoriously susceptible to volatile gas fees, as a large number of market participants try to claim tokens simultaneously. This leads to congestion as the competition for block space intensifies.

However, also developed by Uniswap, CCA uses Permit2, enabling batch approvals for multiple tokens in one signature. This has the effect of reducing transaction costs and associated gas fees by avoiding redundant state updates.

The Bottom Line

The high failure rate of Token Generation Events (TGEs) has long been a barrier to attracting serious institutional capital. The launch of Uniswap’s Continuous Clearing Auction (CCA) represents the crypto sector’s answer to its own challenge.

CCA not only decentralizes mechanisms for price discovery, but mitigates the pervasive risks of market maker selection, flawed tokenomics, and predatory CEX listings.

Though it is regrettable this innovation didn’t arrive sooner, such an important market structure upgrade is a foundational step toward establishing trusted rails for tokenised dollars.