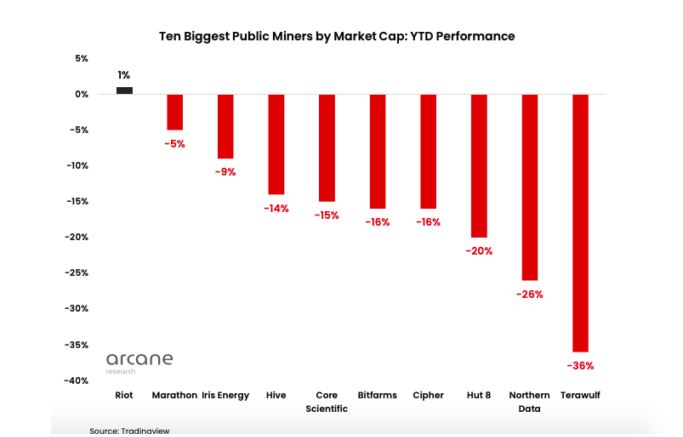

Bitcoin Mining Stocks Have Been Hammered in 2022

Bitcoin mining stocks have seen a sharp decrease in value with the price of Bitcoin (BTC) and the wider crypto market going down in parallel. Mining stocks have especially suffered due to more businesses holding the asset on their balance sheets and the lack of a significant hashrate increase.

As the cryptocurrency market continues on a sharp downtrend, Bitcoin mining stocks have followed. Even though they fared very well in 2021, they’ve taken a bigger knock than the cryptos in 2022. While the digital asset itself was recording losses close to 30 percent, bitcoin mining stocks have taken what amounts to a double hit, with more than 60 percent losses in some cases:

According to Jaran Mellerud, an analyst at Arcane Research, data from the beginning of the year shows the top five Bitcoin mining stocks by market cap have all been halved. Riot – one of the hardest hit by the slump – is down 65 per cent year-to-date (YTD), but is still trading one per cent in the green (which can’t be said for the others).

Additionally, when looking at the top 10 mining companies, the one down the least had lost 41 per cent, a testament to the devastation of the niche. Most of these companies have not grown their hashrate as fast as investors were hoping and this has impacted them significantly. As it stands, 90 per cent of BTC has been mined and the hashrate is at an all-time high.

How are Mining Stocks Affected by BTC Price Drops?

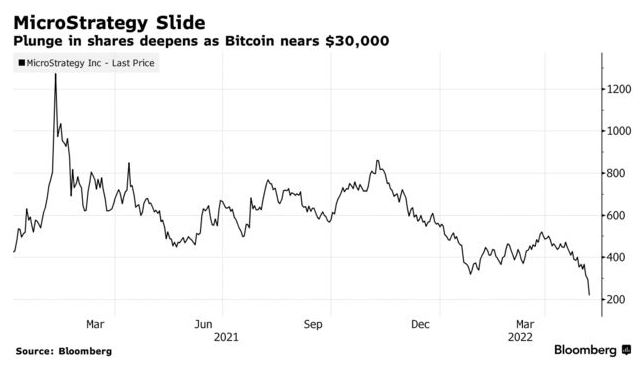

As the price of bitcoin continues to drop, cryptocurrency mining stocks also lose out. One of the major reasons is because many tech and other companies now hold bitcoin on their balance sheets through an exchange traded fund (ETF). Any decrease in price leads to lower revenue for these companies.

Usually, when the BTC price falls, the global hashrate also decreases, but this has not been the case this year. The combination of rising global hashrate and a falling BTC price has led to less BTC mined for these companies and a lower USD denominated value of their mined BTC.

Jaran Mellerud, analyst, Arcane Research

A good example of this is MicroStrategy, which has large amounts of the mined token on its balance sheets that can be used as a proxy by investors who do not want to directly hold bitcoin in their portfolios:

According to Steven McClurg, chief investment officer of Valkyrie Investments, “The correlation between the two asset classes has grown more pronounced in recent months because the number of publicly traded companies involved in blockchain and digital assets continues to grow, and is not likely to reverse course.”

As bitcoin finds its way into organisations (both listed and not), the price of bitcoin will influence their balance sheets. In the case of Nasdaq and tech stocks, both are seeing red crypto fall under their umbrella.