“Bitcoin Is Money Laundering” While Australian and International Financial Institutions Are Accused Of Money Laundering

Since their creation, cryptocurrencies have put an alarm on financial institutions, such as banks, calling them mere schemes that promote money laundering and shady activities. But, Ironically enough, a new report has revealed that at least 16 international financial institution —nine of them are Australian— are behind major money laundering schemes with drugs cartels from South America.

Australian banks were participants in a money-laundering scheme together with South American drug cartels. Accordingly, Australian banks washed more than US$500M dollars.

According to the Australian Border Force —ABF— the cartels moved the drugs with “sophisticated” methods through several countries, primarily in North America, in a joint scheme with banks. These methods alarmed the officers due to the several contradictions on the invoices on behalf of importers and exporters.

But According to Institutions, Bitcoin Still Accounts for Money Laundering

According to the ABF, from 2014 to 2017, at least $100M in drugs were channeled through nine Australian banks and transferred to other institutions in the Middle East and South-east Asia.

The ABF decided to withhold the name of the banks together with the drug cartels over “security”, and “legal” procedures. The case was left to the Border Related Financial Crimes Unit, together with Australia’s financial intelligence regulator, AUSTRAC.

Meanwhile, the president of the European Central Bank, Christine Lagarde, bashes and reduces cryptocurrencies to mere schemes that advocate money laundering and “Shady businesses”.

Likewise, during the confirmation hearing to the post of Treasury Secretary this Tuesday, the former Chair of the Federal Reserve Janet Yellen stated that cryptocurrencies are a major concern due to terrorist financing and money laundering.

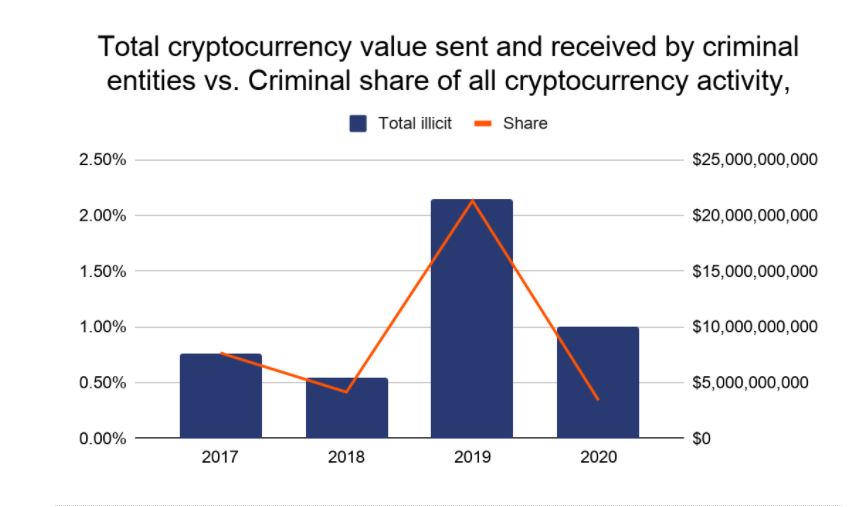

But in 2020, the criminal activity regarding the use of cryptocurrencies only accounted for 0.34% in the market, according to data from Chainalysis.