Bitcoin Hashrate Falls 12% Amid Kazakhstan Internet Shutdown

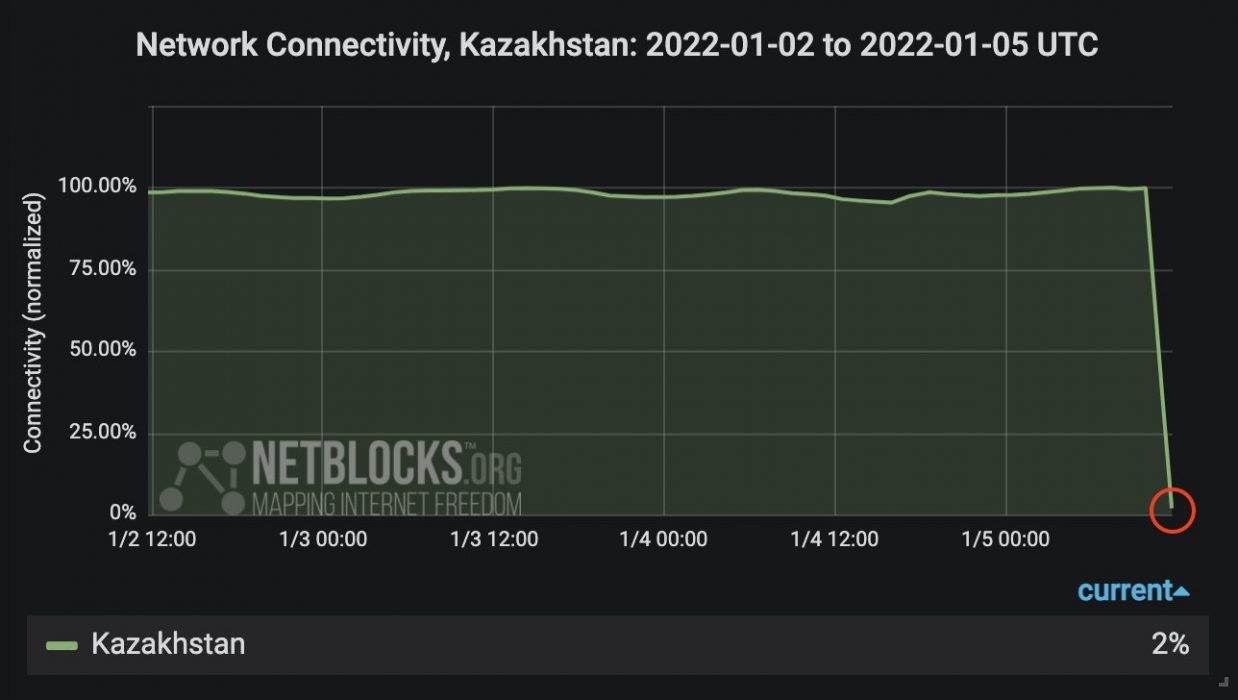

Earlier this week, Bitcoin’s hashrate hit a new all time high, however in a matter of days, it has dropped by 12 percent amid an ongoing political crisis in Kazakhstan where internet blackouts have reduced normalised network connectivity to just 2 percent.

Kazakhstan, the Bitcoin Mining Hub

Over the past decade, the former Soviet Union satellite state has enjoyed a reputation for stability, attracting billions of dollars in foreign investment, including the Bitcoin mining sector.

The country boasts some of the world’s lowest energy prices, which in part, has led to the Central Asian nation accounting for approximately 20 percent of the Bitcoin network’s hashrate. As neighbouring China banned Bitcoin mining in mid-2021, Kazakhstan proved to be one of the beneficiaries, increasing its hashrate even further.

An Ongoing Political Crisis

Initially sparked by anger at recent fuel price hikes, protests soon morphed to encompass a broad anti-government sentiment, leading the country’s presiding cabinet to resign.

Prior to their resignation, in what appears to be an obvious attempt to restrict protestor communications, state-owned Kazakhtelecom shut down the nation’s internet which in turn saw Bitcoin’s hashrate plummet.

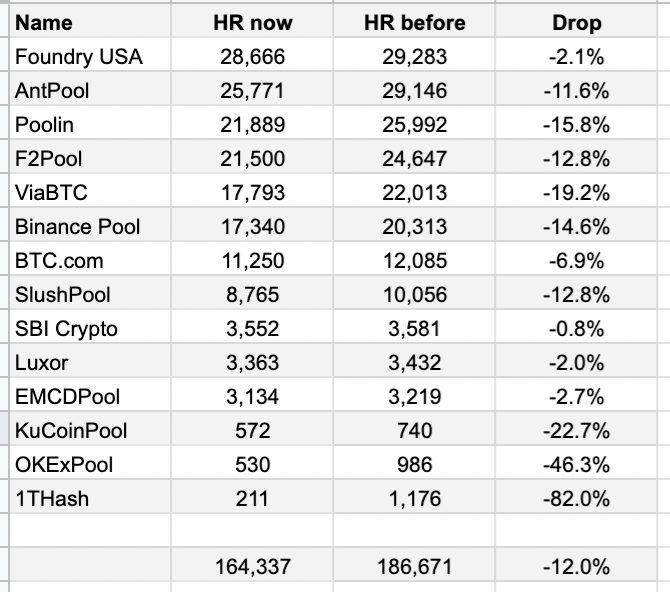

Following widespread internet blackouts, some Bitcoin mining pools were hit harder than others:

Bitcoin Hits Lowest Level in a Month

Independent of the hashrate drop, Bitcoin fell by over 4 percent to US$43,678, its lowest level since December 4.

Putting aside US$110 million in leveraged longs that were liquidated in an hour, this latest dip is largely attributable to a broader shift in market sentiment towards risk-off assets following the Federal Reserve’s signal that it intended to shrink its US$8.3 trillion balance sheet.

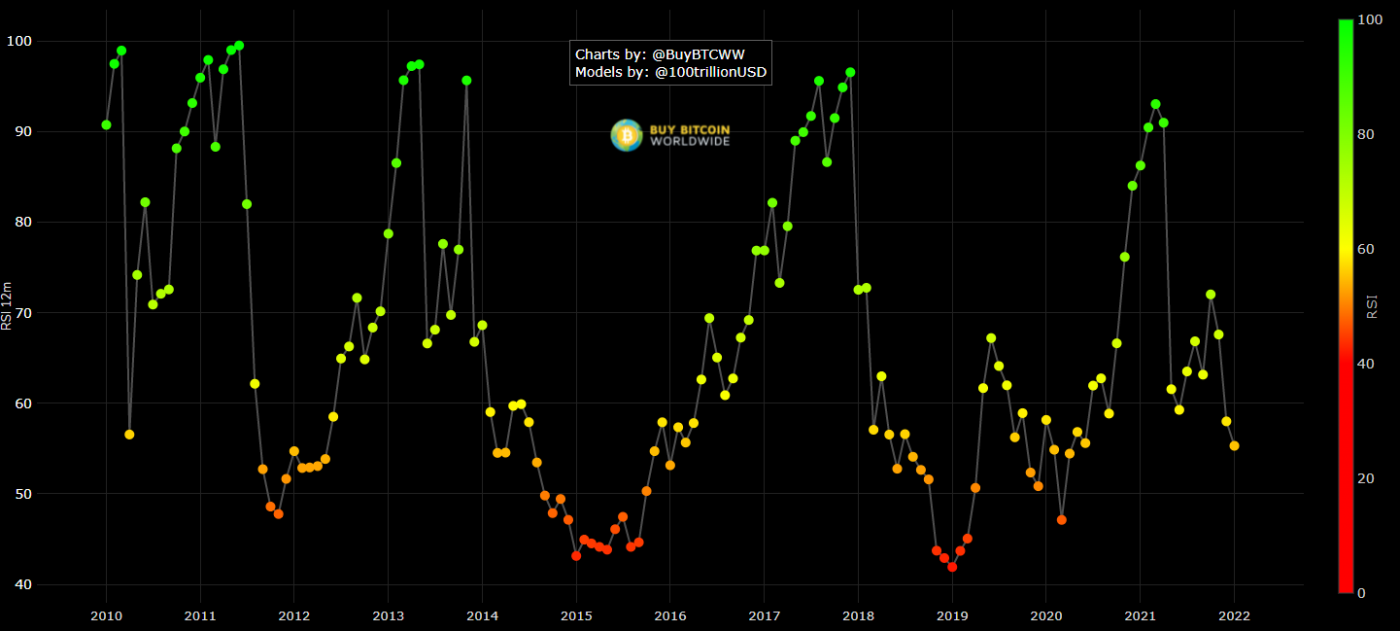

It’s not all bad news however. Looking at Bitcoin’s relative strength index (RSI), which indicates levels of over-bought/over-sold, it is currently lower than it was at the May-July 2021 correction. We know what happened afterwards.

History doesn’t repeat itself, but it often rhymes.