Bitcoin Exchange Flows Reversing Again as Investor Confidence Returns

Glassnode on-chain analysis is showing a possible reverse in exchange flows, indicating investors are looking to hold again.

Crypto Supply is Moving Back to Wallets

According to analysis done by Glassnode, there has been a reduction in supply held in exchange wallets. This means there are more cryptos being taken out of exchanges in the past month than being put in to trade with.

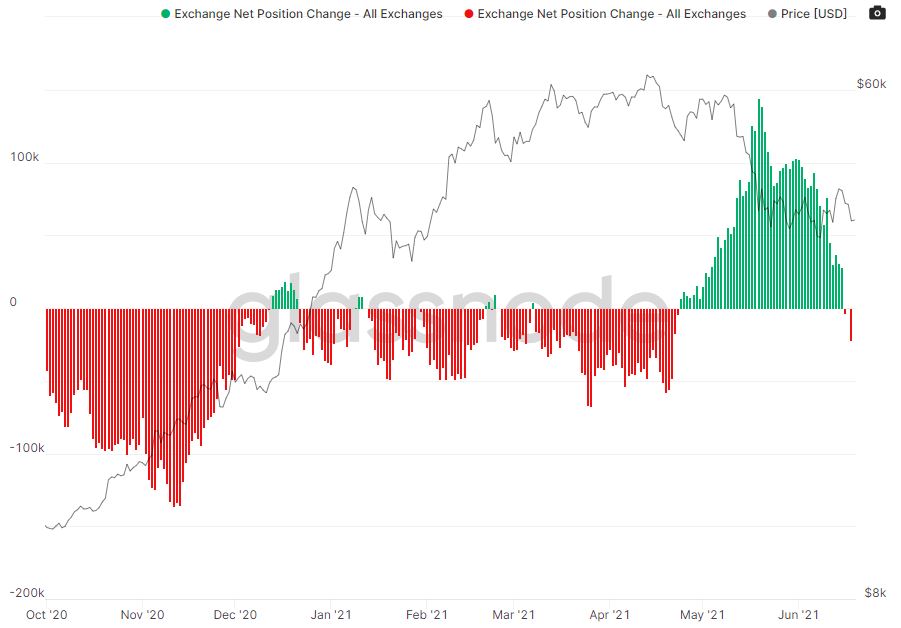

The analysis looks at the supply in all major exchange wallets, including Binance, Coinbase and Huobi, among others. The red bars indicate supply leaving exchange wallets, and green bars show supply moving into exchange wallets.

To some, this is an indication that investors are reverting to HODL mode by putting their digital assets back into their wallets. On June 18, the outflow increased to nearly six times the previous measurement.

Glassnode also recently released an article explaining why the bull run is far from over, based on patterns of accumulation and distribution.

Exchanges Have Been Booming

During the past two months, the amount of cryptos held in exchange wallets have been at a one-year-high. This could have been due to high volatility created by the media at large, as well as regulatory scrutiny that has made holders nervous and ready to sell. This is also why web traffic on crypto exchanges has been off the charts.

The crypto market attracts new investors eager to make money out of volatile assets. However, it’s important to remember which factors can affect the price of Bitcoin and, by extension, the rest of the market.