$43 Billion of Bitcoin is Locked Up in Trusts and Global Investment Funds

A report by Financial News London shows that over US$43 billion worth of Bitcoin is currently held by investment companies.

These funds are spread across hedge funds, ETFs and wrapped Bitcoin (wBTC).

19 Firms Declare $6.5 Billion Share of Investments

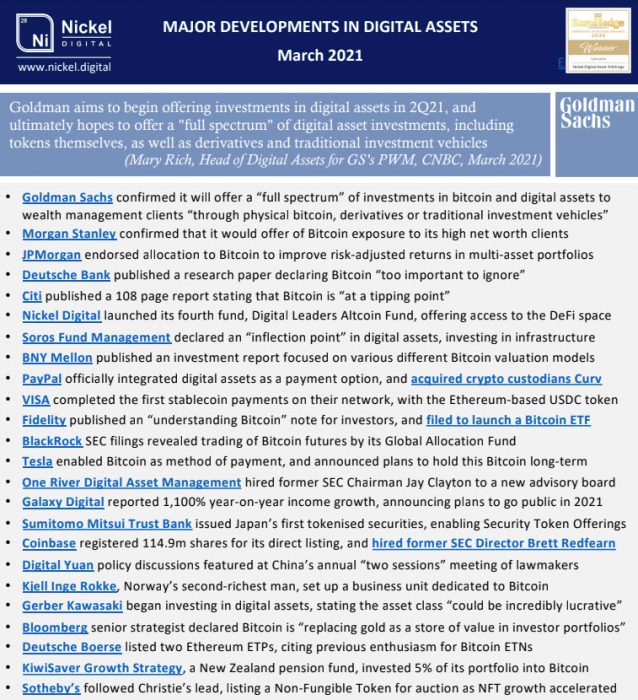

Another report by Nickel Digital shows that of this total sum, around $6.5 billion worth of BTC has been declared by 19 companies, such as Goldman Sachs, Blackrock, Deutsche Bank and JPMorgan.

Commenting on the reports, Nickel Digital CEO Anatoly Crachilov said that not only can BTC serve as a hedge against inflation, its adoption by financial institutions may reduce its overall volatility in the near future.

The cryptoassets space remains volatile as it is going through the early stages of an adoption curve. [This is] a very important endorsement for Bitcoin’s emerging functionality of the hedge against inflation. Increasing allocations by large-scale institutional investors and corporate players is expected to lead to a reduction of [Bitcoin’s] volatility over time, due to a longer-term, stickier type of capital brought by those investors.

Nickel Digital CEO Anatoly Crachilov

The same report estimates that $4.3 billion was spent by these companies purchasing the BTC, bringing a profit of over $2 billion.

The vast majority of these companies are based in the US, with a few other publicly declared Bitcoin investors located in Europe, Australia and Asia. However, another survey by Nickel Digital shows that 81% of European institutional investors believe the amount of crypto purchased by wealth management firms is about to sharply increase.

Although the wind may be blowing in favour of mass crypto adoption, it’s important to remember that in the financial world things can change on a whim – so, as always, Do Your Own Research.