The Wall Street Journal Discusses Bitcoin And The Adoption Of Cryptocurrencies By Institutional Investors

It has been an exciting two months for the cryptocurrency world, especially for Bitcoin. Since it rallied 80 % in just two months, it has settled new market capitalization records and capturing a lot of mainstream media attention. Now BTC lands on the homepage of The Wall Street Journal (WSJ).

In a new report, WSJ discusses the embrace of Bitcoin among institutional traders — also highlighting how BTC gained the attention of famous multimillionaires investors, like Paul Tudor Jones and Stan Druckenmiller — both speaking highly positively about Bitcoin over the past few months.

The Wall Street Journal emphasizes how retail investors, hedge funds, and other companies are hungry for buying and holding cryptocurrency — especially BTC.

The Rapid Growth and Adoption of Bitcoin

More institutions and online financial services are embracing Bitcoin and other cryptocurrencies every day — giving them a big boost in their prices. But also making them more scarce: Grayscale, 3iQ, and ETC Group alone have acquired over 24,000 BTC. That’s roughly translated to $457.764.000,00 million.

This week, BTC reached a level of USD 18,900 (25,700 AUD) on the daily chart, trading as high as 19,400 — prices that are rarely traded.

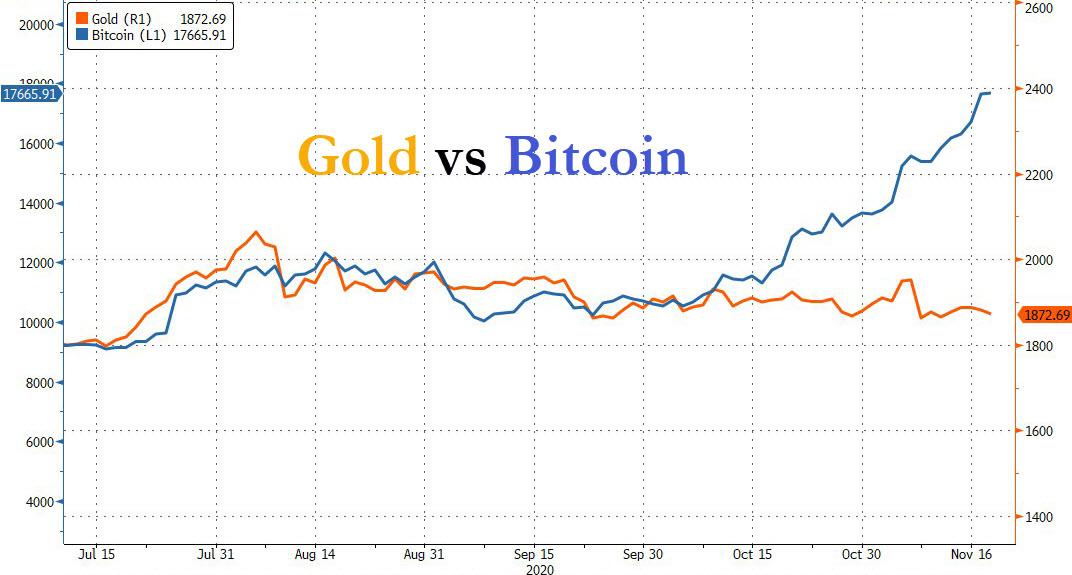

As more high-net-worth investors and financial institutions buy Bitcoin, BTC replaces gold as a store of value, breaking their correlation.

Public figures like Dan Schulman, CEO of PayPal, also spoke about Bitcoin, stating his bullish position with BTC and how cryptocurrencies are moving away from being “just an asset“:

As paper money slowly dissipates and disappears from how people are using transactions, central banks especially on the retail side will need to replace paper money with forms of digital fiat currency.

Stated Schulman for CBNC.

PayPal made a considerable impact in the cryptocurrency world these past months — the company recently removed its waitlist for US residents to buy and hold crypto-assets — and together with Cash App, they have accumulated over 70 % of newly mined Bitcoins.