Goldman Sachs Makes its First Bitcoin-Backed Loan

Wall Street titan Goldman Sachs Group Inc (GS) has further legitimised Bitcoin as a global macro asset class by making its entrance into the world of bitcoin-backed lending.

BTC-Backed Loans Gaining Momentum

According to a report by Bloomberg, GS has offered its first-ever lending facility backed by bitcoin. While similar products are already available from several international crypto-focused businesses, GS’s move is been seen as a significant step towards major US banks embracing Bitcoin lending products.

Borrowing against bitcoin is becoming increasingly popular among Bitcoiners who are looking for liquidity – whether for household expenditure, to put down a deposit on a home, or to buy more BTC – but who do not wish to sell.

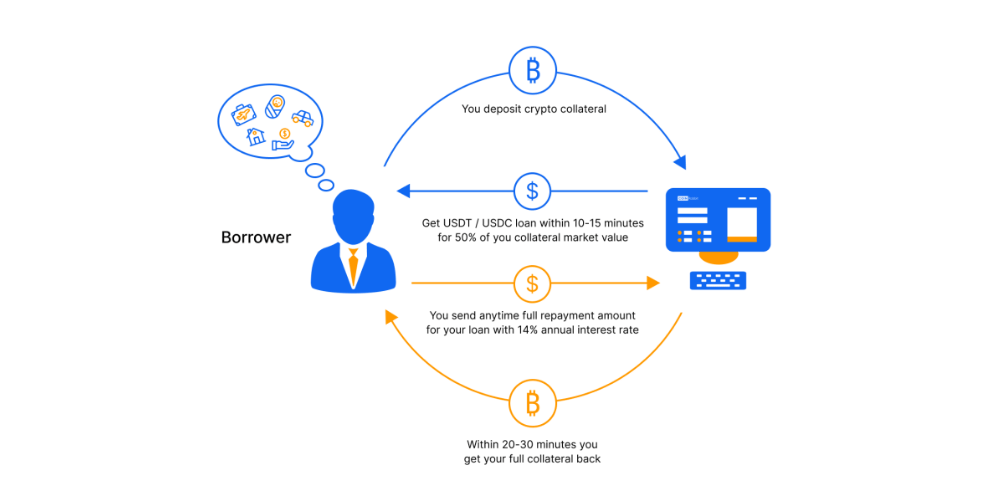

This attractive proposition is rather simple in practice – the investor posts some BTC as collateral, then borrows fiat currency and as the price of bitcoin rises, refinances ad infinitum. Of course, if the price moves in the opposite direction, you would need to post more collateral, reduce the liability or otherwise have a portion of collateral liquidated.

When employed successfully, this strategy allows for HODLers to keep their hard-earned stack without the worry of capital gains tax, which is payable on the sale of digital assets.

Goldman Becoming Bitcoin-Friendly

As recently as 2020, GS was telling its clients to steer clear of BTC. However, on the back of client demand, it has gradually softened its position and can these days be seen as somewhat of a Bitcoin bull.

Last year, GS filed for a Bitcoin exchange traded fund (ETF) and in January it released a report saying BTC was taking gold’s market share, commenting that it could hit US$100,000 by year end. And then last month, GS made history by becoming the first major US bank to facilitate an over-the-counter (OTC) bitcoin options trade:

Despite all these positive signals from a Wall Street mainstay, most Bitcoiners would be justifiably cautious since GS’s embrace of Bitcoin is undoubtedly driven by profits, and not an ideological desire to fundamentally alter the financial system.